Transatlantic tension hits European pharma hard

President Trump’s latest executive order, released May 12, demands that U.S. pharmaceutical companies align domestic drug prices with those paid in comparable developed nations. The so-called Most-Favored-Nation (MFN) pricing initiative doesn’t just target domestic affordability—it weaponises international pricing asymmetries and effectively shifts the burden onto global producers.

At first glance, the move might sound benign—why should Americans pay more than Europeans for the same drugs? But the political reality is sharper: unless foreign producers drop prices or increase supply to the U.S., the White House is threatening aggressive enforcement, including importation waivers, revoked drug approvals, and even export controls. The underlying message: “Stop free-riding, or face the consequences.”

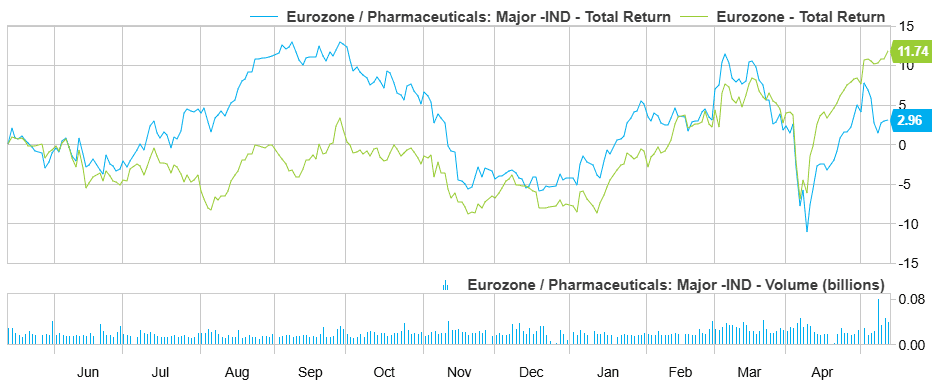

Eurozone Pharma has underperformed in the past month’s recovery

The policy has sent tremors across European pharma. Major players like Sanofi (SAN-FR), Bayer (BAYN-DE), and AstraZeneca (AZN-GB) are increasingly exposed—not just to pricing pressures, but also to potential reputational damage if branded as obstacles to American affordability. While Bayer reiterated its full-year guidance and claimed tariff risk is “manageable,” the wider sector is underperforming. The Eurozone Pharmaceuticals Index has lagged the broader market by nearly 9 percentage points year-to-date.

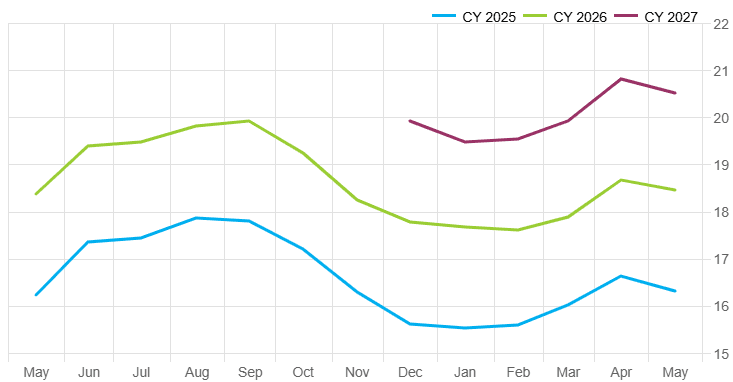

Eurozone Pharma EPS Consensus trend turned negative in May

Eli Lilly thrives as Europe slips

Adding insult to injury, the U.S. market is rewarding its own champions. Eli Lilly’s weight-loss drug Zepbound—approved in late 2023—generated $4.9bn in revenue in its first full year, rapidly closing the gap to Novo Nordisk’s Wegovy ($8.2bn). Novo’s subsequent profit warning sent its share price down by a third, even as Lilly surged. A recent U.S. federal court ruling upholding Lilly’s ability to remove its drug from a federal shortage list has only strengthened its position.

This contrast is emblematic of a deeper trend: the U.S. pharma system—despite its dysfunction—is leveraging policy, legal rulings, and investor confidence to go on the offensive. Europe, by comparison, looks flat-footed.

Bayer’s own Q1 call pointed to growing indirect risks from tariffs, FX headwinds totalling €900m, and margin pressure despite strong pharma performance. Elsewhere, Merck KGaA beat consensus on EBITDA in healthcare but missed on several product lines, including key oncology drugs like Bavencio and Erbitux—raising questions about pricing power going forward.

A new regulatory cold war

What makes the current environment particularly dangerous for European drug makers is its multipolar hostility. On one side is Washington’s hardball pricing strategy. On the other, populist scepticism toward Big Pharma in Europe itself, stoked by high-profile criticisms that the industry is using trade threats to shield profits and dismantle regulation. A scathing editorial this week in Politico accused pharma lobbyists of “holding Europe to ransom” by using Trump’s tariffs as cover to demand looser trial rules and tougher IP protection.

As these narratives harden, the risk isn’t just slower sales growth—it’s a fundamental shift in how governments and patients perceive the legitimacy of Europe’s pharma business model.

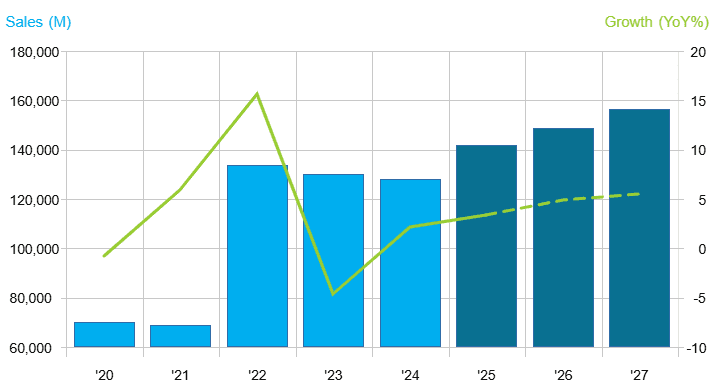

Sales outlook for Eurozone pharma

Outlook: cheaper drugs in America, tougher margins in Europe

With the White House making clear that “global freeloading” will be targeted with regulatory, legal, and trade tools, the pressure on European pharma will only grow. The MFN policy, while still in its implementation phase, introduces unprecedented uncertainty into cross-border drug economics. Even firms like Bayer, who downplay direct exposure, may face ripple effects through margin compression, policy friction, and investor scepticism.

Unless European companies can pivot—on pricing, pipeline, and public trust—they risk being caught in the crossfire between populist drug politics and shifting global demand.

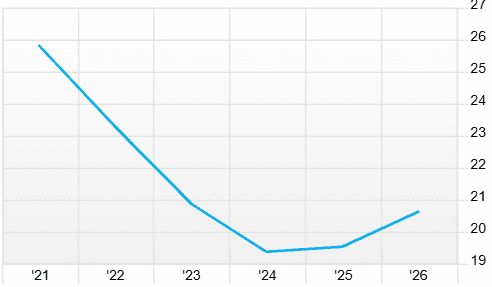

Eurozone Pharma sector operating margins expected to improve in 2026