In a year when much of global equity performance has clustered around mega-cap AI and european defense stocks, a group of actively managed European and emerging markets equity funds has delivered standout results. Each has posted more than 20% annualised returns while maintaining a Sharpe ratio above 1.0 over the past three years. The common denominator? A meaningful overweight to financials and a willingness to stray far from benchmark country weights.

Here are the five funds that stand out, and what drives their returns.

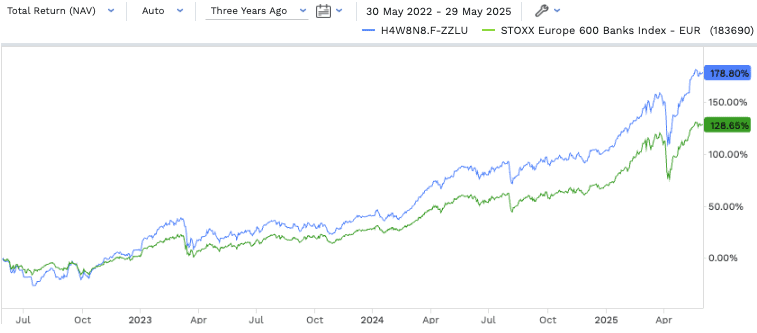

1. Axiom European Banks Equity (Luxembourg)

Annualised return (3Y): 45%

Sharpe ratio (3Y): 1.39

AUM: EUR 230m

Key exposures: European financials (75%), benchmarked to STOXX Europe 600 Banks

Axiom’s fund doesn’t hide its intent—it’s benchmarked to the European banks index and sticks to it with conviction. What separates it from a passive tracker like BNP Paribas’ offering is active stock selection and tactical overlay through derivatives. The fund is heavily tilted toward large-cap banks across the EU, Iceland and Norway, with room to hedge currency risk when needed. In a year when rising net interest margins and cost control have powered bank earnings, Axiom’s focused strategy has paid off.

2. Lemanik High Growth (Italy)

Annualised return (3Y): ~25%

Sharpe ratio (3Y): 1.05

AUM: €136 million

Key exposures: 48% Italian equities, 34% financials, 30% industrials

Despite its generalist “high growth” label, Lemanik’s top holdings reveal a bias toward financials and industrials in Italy. While it’s benchmarked against MSCI Italy, the manager actively excludes much of the FTSE MIB in favour of smaller and mid-sized companies—at least 21% of holdings are required to be outside Italy’s top indices. That tilt toward under-researched, locally rooted firms appears to have created alpha, particularly in a recovering domestic economy.

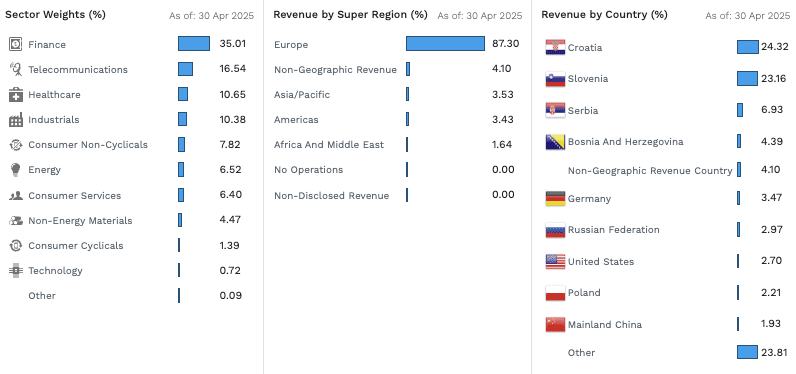

3. Apollo Balkan Equity

Annualised return (3Y): ~21%

Sharpe ratio (3Y): 1.14

AUM: €3 million

Key exposures: 24% Slovenia, 23% Croatia, 35% financials

While small in terms of market cap, it turns out the Balkans have been a quietly explosive pocket of equity performance. With strict minimums for direct stock exposure (at least 51%) and a regional focus few others attempt, this fund has benefited from strong bank earnings, relatively low inflation, and some repricing of country risk. The fund’s volatility is high, but so is its upside. Notably, over 50% of the portfolio is invested in just three countries.

Portfolio Exposure

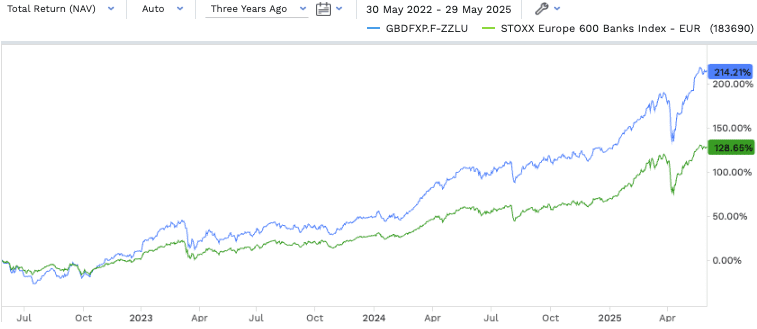

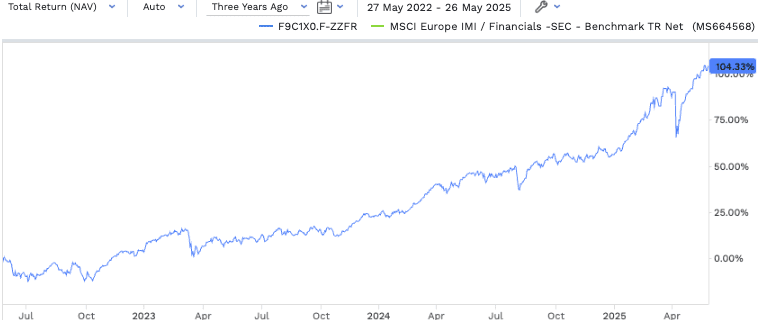

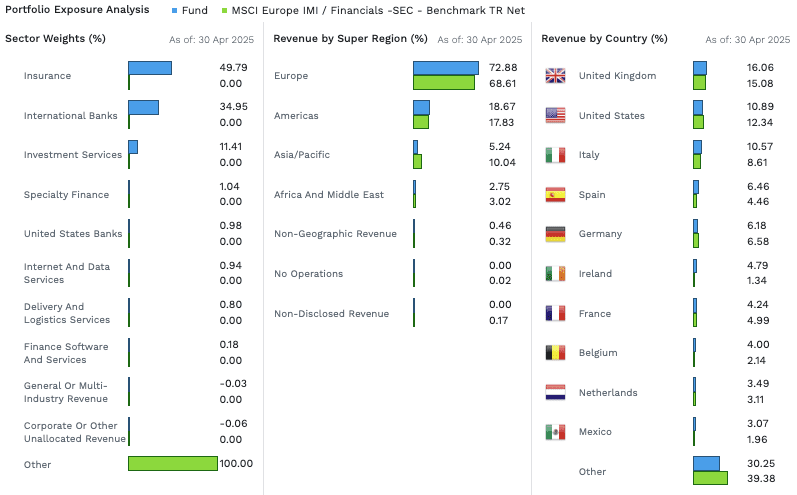

4. BNP Paribas Finance Europe ISR (France)

Annualised return (3Y): ~28%

Sharpe ratio (3Y): 1.23

AUM: EUR 96m

Key exposures: Insurance 50%, Banks 35%

Unlike the other funds, this product has the specific mandate to replicate the STOXX Europe 600 Banks index. That makes it a pure play on the sector’s cyclical revival. Investors who simply wanted clean, low-cost exposure to the rising rate environment and improving European credit cycle have been rewarded. Its returns track the benchmark tightly, with tracking error capped at 1%, and only minimal use of derivatives for hedging.

Portfolio Exposure – Heavy on insurance

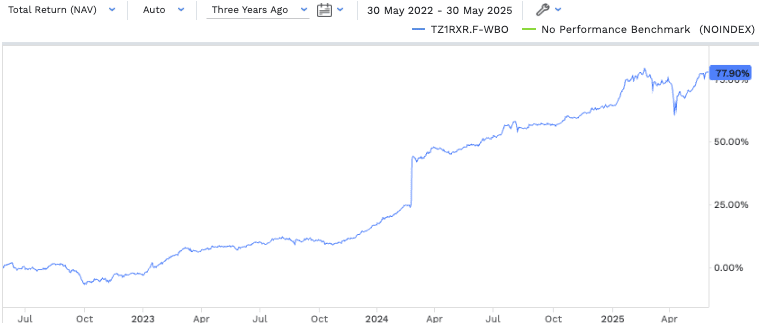

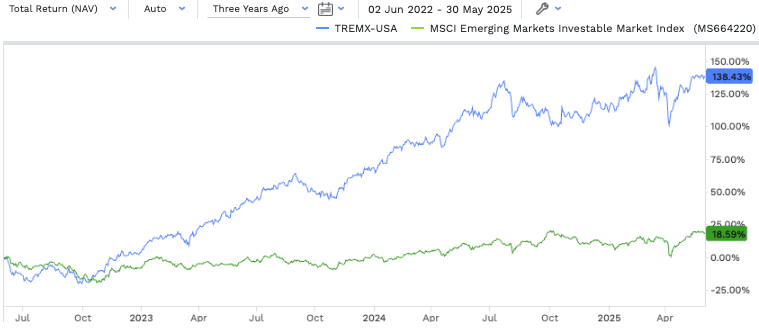

5. T. Rowe Price Emerging Europe

Annualised return (3Y): ~30%

Sharpe ratio (3Y): 1.29

AUM: USD 677m

Key exposures: 27% Turkey, 19% Greece, 63% financials

The outlier in terms of geography, T. Rowe Price’s Emerging Europe fund is a concentrated bet on banks and growth stocks in politically complex markets. Turkey and Greece dominate, but the fund also touches on frontier exposures like Kazakhstan and Ukraine. With at least 80% of assets in emerging Europe and a heavy emphasis on bottom-up stock selection, the fund has found strong upside—at the cost of elevated volatility. The high financials weighting reflects a belief that banks remain the most reliable growth lever in the region.

The takeaway

All five funds differ in strategy and structure, from Luxembourg UCITS to Austrian retail funds, from passive replication to deep regional conviction. But most share a common thread: exposure to financials, tolerance for regional or index deviation, and a willingness to look beyond large-cap comfort zones. Whether by choice or mandate, that positioning has delivered both strong absolute returns and solid risk-adjusted performance, something few large-cap global equity funds can claim in today’s crowded field.