The world is waking up to a new bond market regime, one where long yields are on the march, inflation is not done with us yet, and traditional hedges behave in unfamiliar ways. The steepening of global yield curves—led by the US, Germany, and Japan—reflects deeper tremors in the economic bedrock. The comforting fiction of transitory inflation has expired. Now comes the reckoning.

A world of steepening curves and sticky prices

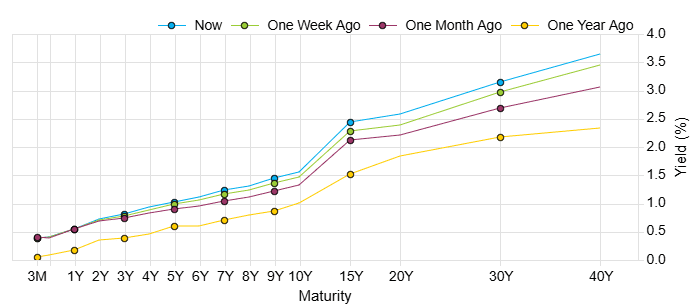

In the past year, 30-year yields in Japan have risen more than 80 basis points. That may sound tame by Western standards, but in a country where rates barely twitched for decades, it marks a seismic shift. The US 5s30s curve has steepened nearly 95 bps since mid-2023, while Germany’s curve is up almost 100 bps. Japan leads the pack with a staggering 208 bps steepening, a clear sign that yield repression is dead, and duration is no longer a safe harbour.

This is not a clean reversion to normalcy. It’s a recalibration under stress. Inflation is proving far more stubborn than central banks expected. Japan’s core CPI (ex fresh food) has now clocked in above 3% for five straight months. That’s after nearly three decades of disinflation. In the UK, food inflation just hit its highest level in a year at 2.8%, nudged up by policy-driven cost increases—from higher national insurance to a living wage hike and a looming £2bn packaging tax. Across markets, “base effects” have faded. What remains is structural.

Yield Curve Japan

BOJ governor Kazuo Ueda calls it a narrowing gap between underlying inflation and the target. Translation: excuses for inaction are running out. Inflation expectations in Japan have quietly climbed to 1.5–2%—their highest in 30 years. The BoJ’s insistence on ultra-loose policy is looking increasingly disconnected, especially with the yen under pressure and global capital starting to reprice Japanese debt risk.

Inflation: the escape hatch no one wants to talk about

Paul Tudor Jones, never one to mince words, recently told CNBC: “All roads lead to inflation.” It’s a point worth dwelling on. Every major civilisation that has inflated away its debt did so not because it was easy, but because it was the only politically viable option left.

Governments are spending like they’ve forgotten the 2010s ever happened. The US faces trillion-dollar deficits even in a “soft landing” scenario, with Moody’s already flashing warning signs. The UK is layering costs on retailers and workers in the name of fairness, but at the price of higher end-user inflation. Japan’s fiscal maths has long been fantasy, but now the bond market is starting to call the bluff.

Yet central banks remain caught in a strange purgatory. The Fed, despite cooling CPI prints, has seen markets price out more than 50 bps of 2025 rate cuts in just a few weeks. Labour markets are still tight. Corporate earnings don’t show stress. And retail sales—like in the UK this April—are rising, not falling. Whatever cracks exist in the consumer story are being patched by wage growth and liquidity still sloshing in the system.

Positioning in a regime with no easy hedges

This is where things get tricky. Traditional portfolio construction tools are creaking. Duration risk is no longer protection, it’s a source of volatility. The idea of bonds rallying in a downturn assumes a rate-cutting central bank. But if inflation proves sticky, that assumption falls apart.

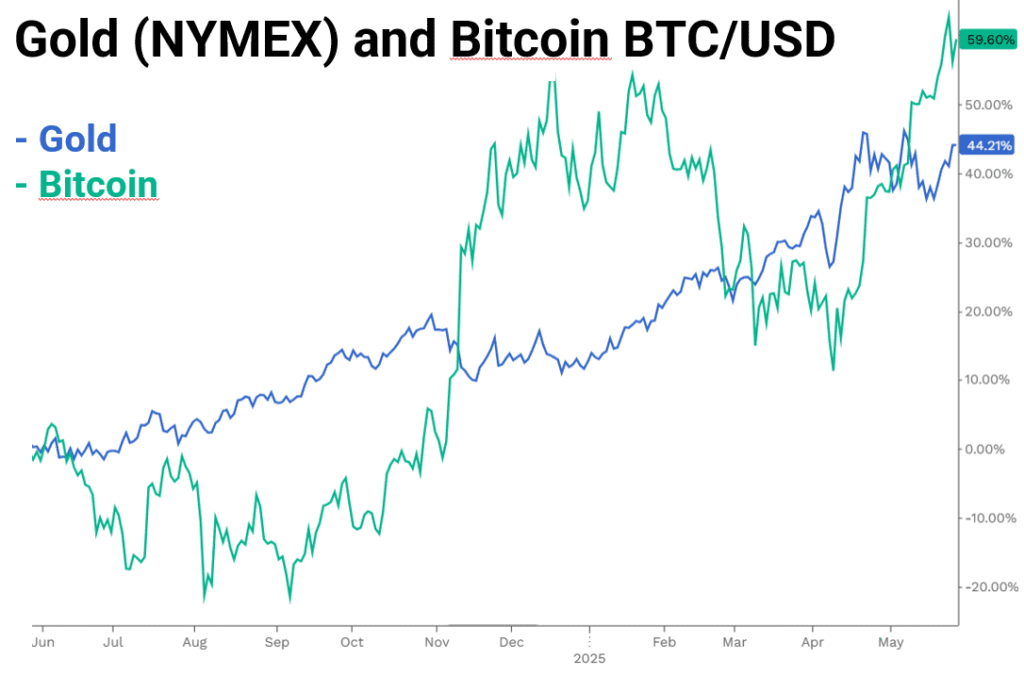

So what’s working? Gold, for one, has surged 27% year-to-date. Investors clearly see it as an escape valve. More intriguing, Bitcoin has clawed its way back, now up 18% YTD after lagging earlier this year. In the past month, BTC and gold have rallied in tandem, a rare correlation that suggests both assets are being treated as stores of value in a world of degrading fiat credibility.

This co-movement isn’t a vote of confidence in the monetary status quo. It’s the opposite. It says investors are preparing for a world where inflation is not just higher, but more erratic. Where policy choices, on tariffs, fiscal spending, and trade, have second- and third-order effects. And where tail risks can no longer be offset by a simple 60/40 split.

The sharp steepening of global yield curves reflect a fundamental repricing of long-term risk. Inflation run a clear risk of not being transitory, and markets are adjusting to the reality that central banks may not return to aggressive easing cycles any time soon. For investors, this means traditional diversification strategies tied to duration are being tested. Assets once considered safe are now more sensitive to policy uncertainty, fiscal strain, and geopolitical friction.