A stealth tax on the rich, a silent boost to the state

Buried beneath the market’s recent theatrics lies a subtle mechanism that could help the U.S. finance its trillion-dollar deficits without igniting social unrest or a bond market revolt. The idea is deceptively simple: impose 15% tariffs on about $3 trillion worth of imports. That’s $450 billion in annual revenue—without touching income tax or slashing spending.

These tariffs are not broadly based. They hit high-end discretionary goods: electronics, designer clothes, furniture. Households in the top income quintile, responsible for half of U.S. consumption and sitting on a staggering $98 trillion in assets, will bear the brunt. But crucially, they won’t flinch. For the ultra-wealthy, elastic goods become inelastic. Prices rise. Purchases continue.

It amounts to a quiet wealth transfer—voluntary, efficient, and politically frictionless. At just 0.5% of top-tier household wealth, the tariffs are too small to alter behaviour or provoke wage demands. Inflation ticks up, yes, but not enough to trigger the kind of wage-price spiral that central bankers dread. The working class doesn’t riot, and the bond market barely stirs.

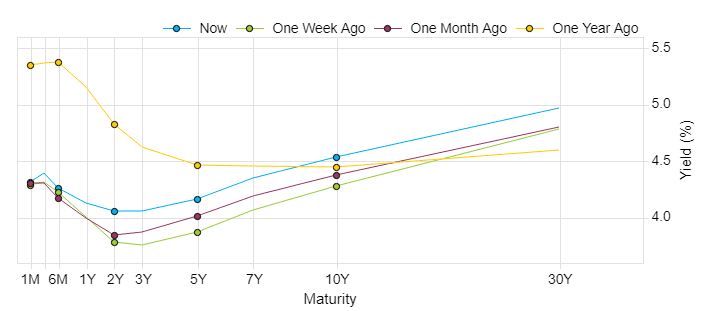

US Yield Curve – Now, a week, a month and a year ago

The 2.5% peg: echo of a wartime playbook

Yet even a clever tax scheme can’t fill a $2 trillion hole. The tariffs cover $450 billion. So where does the rest come from? Enter the bond market.

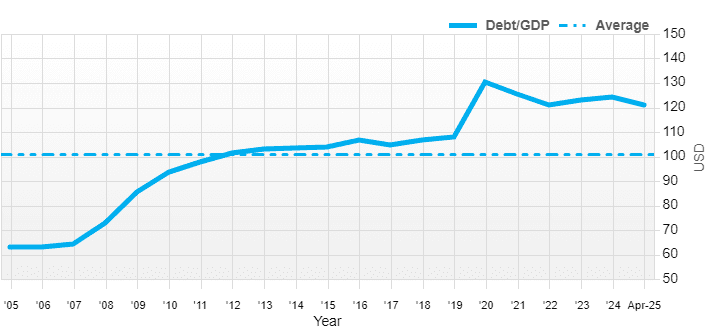

If the Fed were to cap the 10-year Treasury yield at 2.5%—as it did from 1942 to 1951—it could shave another $308 billion in interest costs. Add that to the tariff haul, and nearly $760 billion in deficit reduction begins to take shape. The remaining shortfall—some $250 billion—could be inflated away slowly by letting CPI run a bit hotter than 2%. Call it controlled erosion.

But pulling this off would require rare coordination. Fiscal policy would need to pivot toward consolidation. Monetary policy would need to accommodate it, pushing rates toward 1.5% and pinning the long end. The dollar would need to weaken—softening the blow of slower growth and reindustrialisation.

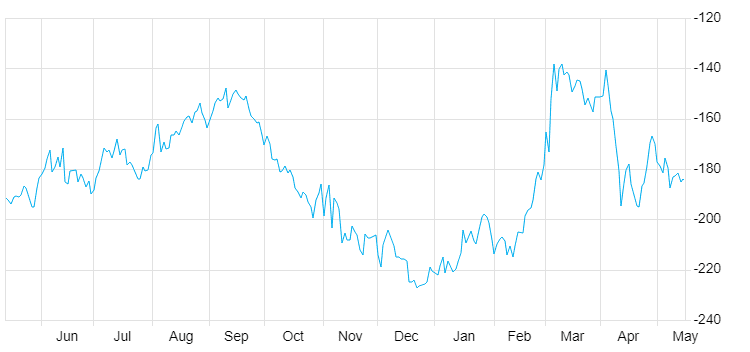

Is this fantasy? Not entirely. Trump advisers like Stephen Miran are already floating ways to “alleviate the burdens” of reserve currency status. Bloomberg reports currency pledges are not being formally included in trade talks, but FX traders are already treating a weaker dollar as baked in. The S&P’s 22% rebound from April lows is stalling, and bond yields are rising without a clear anchor. It’s a market that smells regime change.

US Debt / GDP 20 years

Oil, deficits, and petrodollars 2.0

The geopolitical choreography is also worth watching. The White House recently trumpeted a $1.2 trillion economic pact with Qatar—its largest ever with a Gulf state. It includes a $96 billion Boeing deal, $38 billion in military commitments, and a sprawl of infrastructure and tech tie-ups that echo the ambition of the original 1970s petrodollar strategy. The message: America is open for business—on its terms.

Crucially, these deals are aimed at propping up U.S. manufacturing and energy security, while locking in Gulf cash. It’s fiscal stimulus via the back door. Combined with earlier $600 billion commitments from Saudi Arabia, the administration is reassembling the scaffolding of a dollar-centric order without the Bretton Woods pomp.

Still, the pressure remains. The 10-year Treasury yield keeps rising—hitting 4.5%—despite falling inflation and tepid growth. Foreign demand is anaemic. The Fed is still tightening. The U.S. bond market is being asked to absorb record issuance without the support of its historical buyers. The longer this continues, the greater the risk of wider mortgage spreads, falling liquidity, and a drag on long-duration equities.

Spread Europe 10Y vs. US 10Y

Every 50 years, a reset

The last time America redefined the financial system was 1971–74. It exited gold, built the petrodollar, and sold the world on a new monetary architecture. Fifty years before that, it was the wartime yield peg. Today, we stand at a similar junction.

If the so-called Bessent Reset—named for the hedge fund manager who popularised this strategy—takes hold, it won’t arrive with a press release. It will happen in the margins: yield caps, tariff trickery, dollar diplomacy. By the time investors realise, it will already be the new normal.

And if it succeeds, the world may sigh in relief—not because it agrees, but because there is no alternative.