Services-led slump spoils fragile optimism

What was supposed to be a springtime stabilisation for the eurozone has wilted under the weight of disappointing services data. The HCOB composite PMI fell to 49.5 in May, below the crucial 50 threshold and marking the first contraction of 2025. Analysts had expected 50.7. Instead, the services sector sank to 48.9—the lowest reading since January—despite forecasts of 50.3. It’s not just a statistical miss; it’s a psychological blow. Business confidence among service firms now hovers near three-year lows, as domestic demand continues to limp forward.

Germany, the supposed bastion of industrial resilience, fared worse. Its composite PMI slumped to 48.6, with services dragging the headline. France remains in contraction for a ninth straight month. There is no rotation, only retreat.

Yes, manufacturing managed a feeble pulse—rising to 49.4 from 49.0—but this is hardly cause for celebration. That uptick owes more to opportunistic front-loading of orders ahead of possible U.S. tariffs than any structural rebound. Oil prices slipping and the growing anticipation of more ECB cuts are helping sentiment, but the real economy remains locked in a low-gear drift.

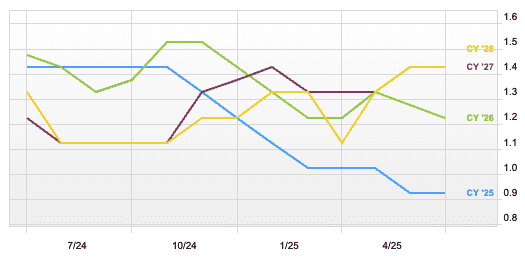

Eurozone Real GDP Growth Year Trend

Currency stumbles and markets follow

The reaction in currency markets was immediate. EUR/USD fell to 1.1300 after the data release, a telling signal that traders are no longer buying the narrative of an imminent eurozone recovery. European equity indices joined the retreat: STOXX 600 dropped 1%, FTSE 0.8%, DAX 0.9%, and CAC 1%. Travel and China-exposed stocks led the decline, while defensives tried to stem the tide.

Even Wednesday’s all-time high on the DAX proved ephemeral. The rally lacked conviction, built on air pockets of liquidity rather than fundamental strength. Now, the reversion has come. Bond markets are jittery—30-year U.S. Treasury yields touched 5.10%, while German bunds nudged up to 2.65%. Investors aren’t just concerned about Europe’s data—they’re unnerved by the broader backdrop of rising U.S. yields and geopolitical drift.

The illusion of optimism

There was one bright dot on the macro radar: Germany’s Ifo Business Climate Index edged up to 87.5 in May, beating expectations slightly. But even this whiff of optimism is suspect. It likely reflects a domestic sugar high from fiscal loosening, infrastructure pledges and a new government honeymoon. Strip away the politics, and the structural issues—an ageing workforce, weak external demand, and tariff risks—still gnaw away at potential growth.

The ECB, for its part, has already begun easing, bringing the deposit rate to 2.25%. More cuts are expected, possibly down to 1.75% before year-end. But this is not policy on the front foot—it’s a defensive crouch. Inflation may have cooled from its peak, but core inflation still sits at 2.7%, far from tamed. The central bank is navigating a minefield: move too slowly, and growth stalls; move too fast, and credibility cracks.

A region adrift

Europe isn’t collapsing—but it is drifting. Sectoral imbalances, waning demand, and brittle sentiment have undercut the fragile narrative of recovery. Services, once the anchor of resilience, now pull the eurozone into contraction alongside the still-anemic industrial sector. Equity markets are flinching, the euro is slipping, and monetary policy is cornered. This isn’t a cyclical pause—it’s structural stasis in slow motion. And unless something gives—fiscal coordination, energy transition tailwinds, or geopolitical clarity—the eurozone will keep circling the runway without ever taking off.