Tesla Faces Its First True Test Since 2020

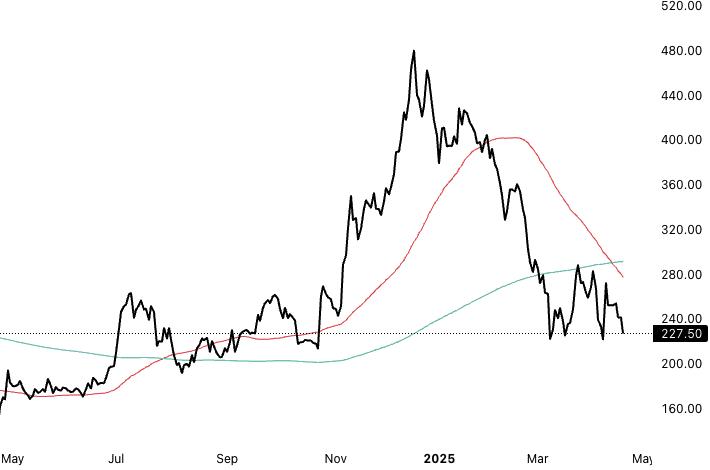

The euphoria is gone. In its place, an awkward silence from bulls and a recalibrated outlook from even the most loyal analysts. Q1 2025 delivered a harsh jolt: deliveries slumped to 336,681, the worst result since Q2 2022. Revenue estimates fell by more than $2 billion in a matter of weeks. EPS forecasts followed. The story isn’t about one bad quarter—it’s about whether the narrative has fundamentally shifted.

Tesla needs to deliver nearly 1.5 million vehicles over the next three quarters to return to growth. That means quarterly averages pushing the edge of the company’s manufacturing capacity—and that’s without factoring in tariff risks, ASP deterioration, and geopolitical tension.

And yet, here we are. Some investors still see a 35% upside. They believe Tesla has crossed the Rubicon from carmaker to platform. Energy storage, AI-driven autonomy, robotaxis—the promise is enormous. But the present? Messier.

The ASP Problem and Margin Erosion

Tesla’s average selling price (ASP) hasn’t risen in nearly three years. In Q4, ASPs were down by $3,700 YoY. In Q1, the refreshed Model Y—popular but cheaper—further pressured prices. Meanwhile, Tesla leaned on incentives and 0% APR offers just to clear inventory.

Margins are taking a hit. Production outpaced deliveries by 26,000 vehicles, hinting at unsold inventory piling up. In Q4, gross profit per vehicle hovered near $5,000. In Q1, that figure likely fell further, especially with ramp-up costs from Model Y and Megapack expansions.

Energy and Services: Diversified, But Not Enough (Yet)

Tesla bulls hang much of their optimism on non-auto segments. Tesla Energy is growing, but not without caveats. Revenue has decoupled from deployment volume. Despite a 244% increase in deployments last year, Q4 revenue rose just 113%. Price pressure is real.

Services are up—but they still represent a small sliver of total revenue. And while FSD miles are exploding (from 1 billion in March 2024 to nearly 3 billion by year-end), this data goldmine has yet to translate into financial results. Robotaxi and Optimus remain on the horizon.

Geopolitical Friction: Home Advantage May Not Be Enough

Trade war tensions are back. Tesla’s position is strong in the U.S., where most of its vehicles are assembled. But China—which accounts for nearly 40% of Tesla’s deliveries—is a wildcard. March sales in China grew 18.8% YoY, but broader geopolitical risks loom.

Europe, meanwhile, is a slow bleed. Sales are down, and new tariffs could dent profitability. Musk’s foray into the Department of Government Efficiency (DOGE) has added to investor unease, fueling concerns over distraction and political backlash.

The Valuation Case: Premium Price, Platform Potential

Tesla trades at a forward PE ratio north of 90, nearly 600% above sector median. That’s hard to justify on 1% revenue growth. But for those who believe in the platform—a $1 trillion-plus valuation built on energy, autonomy, and AI—it might still be cheap.

Estimates suggest a fair value of $1.05 trillion, a 35% premium to today’s $776 billion market cap. That pencils out to $325/share. It’s a bet not on 2025, but on 2027 and beyond. On a world where Tesla isn’t just surviving an EV slump but defining the next wave of mobility.

Conclusion: The Pivot or the Plateau?

Tesla’s Q1 stumble isn’t catastrophic. But it’s not irrelevant either. The company has scale, ambition, and diversified revenue streams. Yet margins are thinning. Growth is slowing. And the gap between promise and performance has widened.

The next earnings call will be pivotal. A beat on revenue and clarity on margin strategy could reignite confidence. A miss—or more vague talk of future robotaxis and humanoids—may not be enough.

For now, Tesla sits at a fork in the road. Whether it powers ahead or coasts on hype may be the most consequential question of 2025.

I/O Fund’s Beth Kinding on Tesla: