Low-income fatigue sets in

There’s no shortage of evidence that the bottom half of the U.S. consumer pyramid is under pressure. McDonald’s CEO Christopher Kempczinski didn’t mince words: “Comp sales declined 3.6% in the U.S., largely reflecting broad-based consumer challenges, particularly amongst the lower- and middle-income cohorts.” He added that traffic from higher-income guests “remains solid”, highlighting a growing divergence in behaviour.

Wendy’s CEO Kirk Tanner saw much the same. “We saw broad-based pressure in the quarter. The pressure was more acute with those households under $75,000… pulling back by high single digits, low double digits, especially in March.” For a sector built on frequency and affordability, the drop in traffic is a red flag.

Discretionary spending is also taking a hit elsewhere. Harley-Davidson CEO Jochen Zeitz is hearing it directly from the customer base: “Roughly half of our existing owners feel that the current economic environment is causing them to delay a purchase… the primary reason is interest rates and overall economic uncertainty.”

Stanley Black & Decker CEO Donald Allan Jr. reported a 2% decline in Power Tools revenue, driven by pressure in the DIY category. The implication is straightforward: consumers are delaying non-essential purchases.

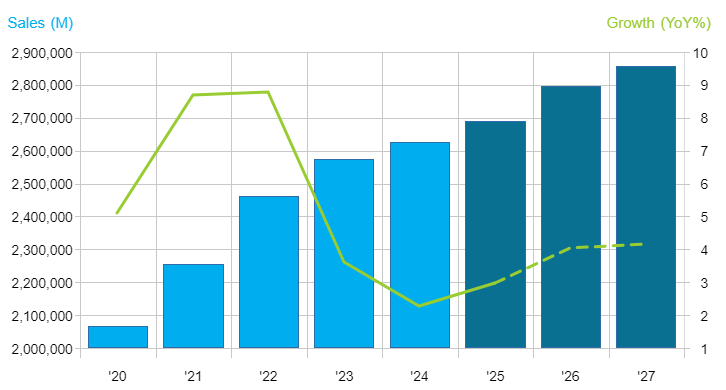

S&P Composite 1500 Consumer Staples

Travel shows the fracture clearly

The travel and leisure sector offers a particularly stark view of this divide. Hilton Worldwide CEO Christopher Nassetta flagged “weaker trends continuing into the second quarter”, with short-term bookings flat year-on-year as travellers stayed on the sidelines. Hyatt CEO Mark Hoplamazian echoed that tone, highlighting softness in U.S. bookings, “down in the high single digits versus last year,” particularly in upscale brands.

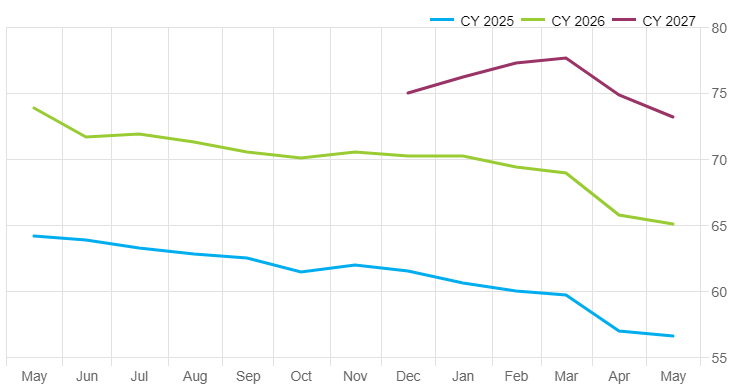

S&P Composite 1500 Consumer Discretionary

Glenn Fogel, CEO of Booking Holdings, pointed to a contraction in U.S. length of stay—interpreted as “consumers becoming more careful with their spending.” Yet at the other end of the spectrum, Airbnb’s CEO Brian Chesky was surprisingly bullish: “The higher-income traveller [is] somewhat unimpacted by current macro conditions,” with bookings at higher price points still strong.

And then there’s Live Nation. CEO Michael Rapino dismissed the idea of a slowdown outright: “We haven’t felt it at all yet.” In April alone, Chris Brown sold a million tickets, and Lady Gaga sold out, with total volumes up 18% year-over-year. “We haven’t seen a consumer pullback in any genre—club, theatre, stadium, amphitheatre,” Rapino said.

Credit still flows—for now

For now, credit markets are holding firm. M&T Bank CEO René Jones said delinquencies “still are really good” and spending patterns “pretty consistent”, though he noted stress remains at the lower end. Affirm CEO Max Levchin went further: “We actually saw a slight uptick in prepayments… even adjusting for tax seasonality, we saw an increase year-on-year.” A small but telling positive signal.

Still, CEOs remain cautious. Carlyle Group CEO Harvey Schwartz captured the mood: “This is not an environment where I’d say it’s a red light or a green light—it’s sort of a different shade of yellow.” Capital is being deployed, he said, “but people are being very, very thoughtful about it.”

China stalls, Europe steadies

The global picture offers little comfort. In China, weakness persists. Mettler-Toledo CEO Patrick Kaltenbach noted that “market conditions remain soft”, and no new stimulus appears imminent. Prada’s Andrea Guerra was blunt: “The only reason the second half will be better is because comps are easier.”

Europe, by contrast, looks steadier. Mondelez CEO Dirk Van de Put said European consumers are “switching to more frugal spending… smaller pack sizes… and discounters,” but overall confidence remains “stable.” Airbnb’s Chesky added that international travel patterns are simply shifting: “Canadians who used to come to the U.S. are now going to Mexico, France, Japan.”

The verdict: a consumer economy with a split personality

If one message runs through this earnings season, it’s this: the U.S. consumer is not monolithic. Lower-income households are under strain, travel is fragmenting, and discretionary spend is under pressure. But high earners are still showing up—at restaurants, concerts, and in premium hotel suites.

Whether this divergence widens or narrows will depend on what happens next: interest rates, inflation, and employment trends. But as McDonald’s Kempczinski warned, the “cumulative impact of inflation and heightened anxiety” is real—and already weighing down the half of the economy most vulnerable to being overlooked.

Policy at a crossroads

For the Federal Reserve, the message from corporate America complicates an already fraught decision. The consumer is not collapsing, but neither is it confidently pushing forward. As inflation proves sticky at the top and fragile confidence creeps in from below, the Fed’s margin for error narrows. A bifurcated economy is harder to steer. Cut too soon, and risk reigniting price pressures among high-income spenders; hold too long, and the pressure on low-income households may fracture demand more broadly. For equity markets, the split is equally consequential. Strong earnings from luxury travel, live entertainment, and premium segments have helped prop up indices—but those gains rest uneasily on a shrinking base. If the low-end consumer retrenchment spreads, the market’s narrow rally could unravel just as rate policy hits its most delicate phase.