From discount bin to market darling

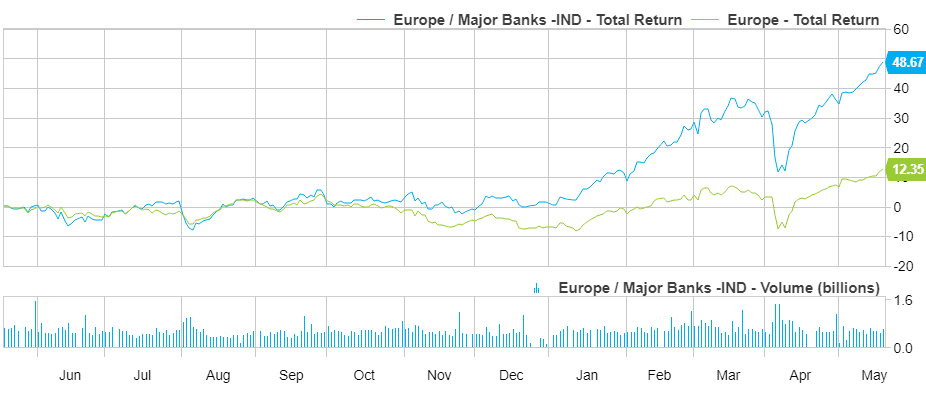

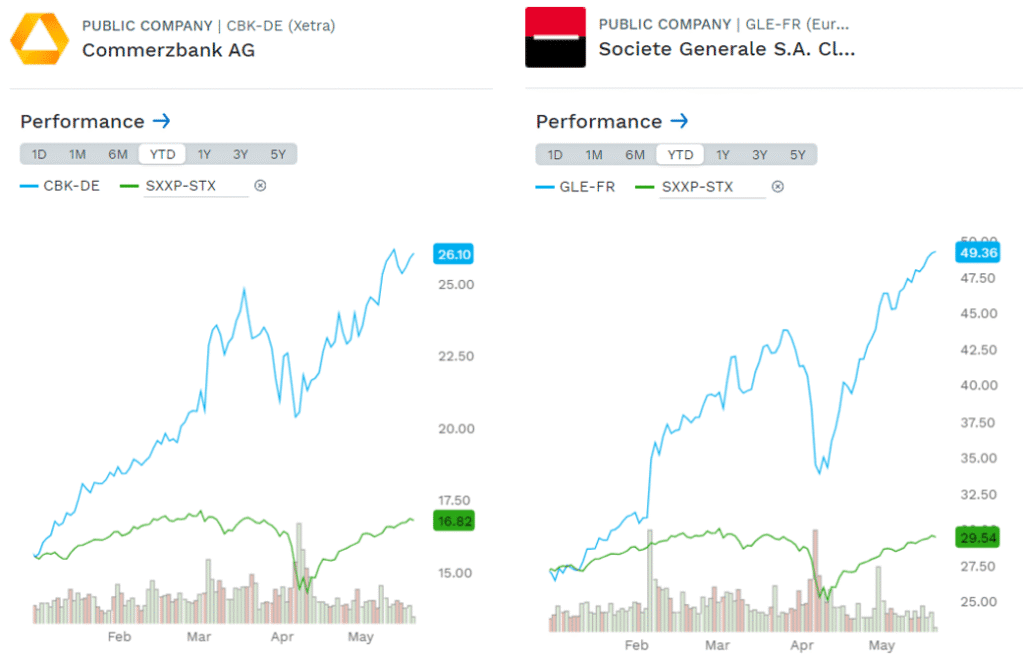

The numbers speak for themselves. European financials have outperformed their US peers sixfold so far this year, +33% vs. +5%, buoyed by a 9% rise in the euro and a string of earnings surprises. Take Commerzbank: the German lender posted a Q1 net income beat of 20%, driven by a resilient €7.8bn in net interest income (NII) and stronger-than-expected commission fees. Operating results topped expectations, and the bank reaffirmed its plan to return 100% of net income before restructuring costs to shareholders. It now sees its CET1 ratio hitting at least 14.5% by year-end, up from the prior 14%.

Investors liked what they heard. Shares jumped and Morgan Stanley’s Pamela Zuluaga, JPM’s Kian Abouhossein and Mediobanca’s Riccardo Rovere all reiterated overweight or outperform ratings. With targets ranging from €27 to €30 sell-side sentiment now tilts decisively bullish: 58% buy, 37% hold, just 5% sell.

Performce Major Euopean Banks

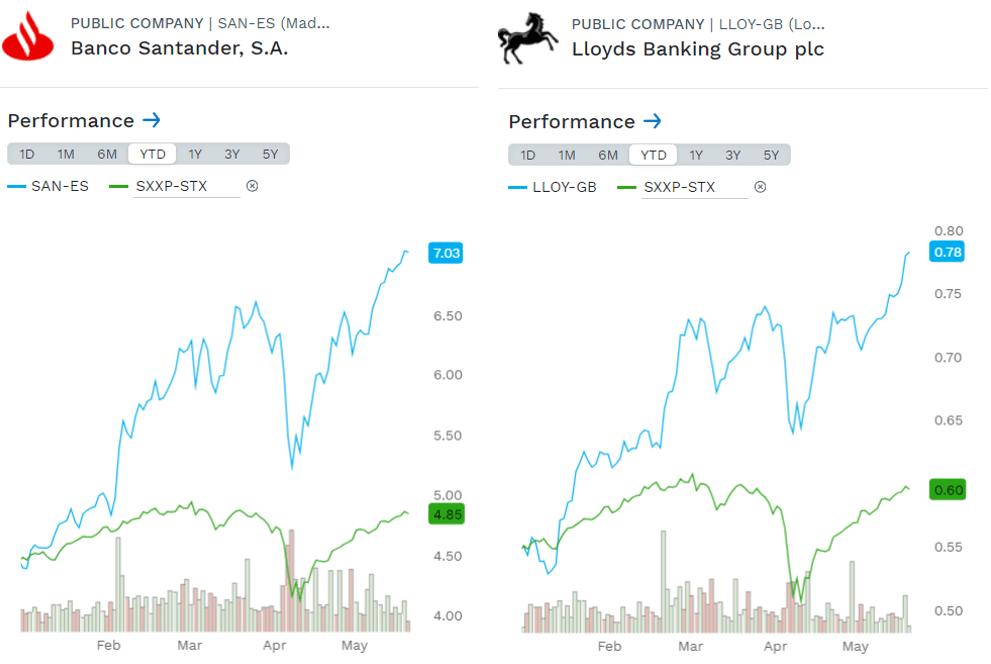

Lloyds and Santander lean into cost and capital discipline

Across the Channel, Lloyds Banking Group struck a more measured tone, but the underlying message was the same: stable income, prudent provisioning, and confident capital return plans. The bank guided for £13.5bn in NII for 2025, a cost base of £9.7bn, and a 13.5% return on tangible equity. Shareholder returns will be supported by strong capital generation of 175bps, and tangible NAV per share is set to rise materially.

The message: Lloyds is managing through the noise. A £100m ECL adjustment tied to tariff uncertainty and a dip in mortgage spreads hint at competitive pressure, but deposit growth remains strong and other income rose 8% YoY.

At Banco Santander, the story is one of global scale and flexibility. The bank expects a 16.5% RoTE in 2025, even as reported NII is slightly down in current euros due to FX and rate headwinds. Cost discipline remains front and centre, with operating expenses projected to decline year-on-year. The Spanish lender is targeting up to €10bn in shareholder distributions for 2025–26, and platform investments continue to underpin its expansion across Latin America, the US, and digital verticals. It’s a case study in using scale to buffer volatility.

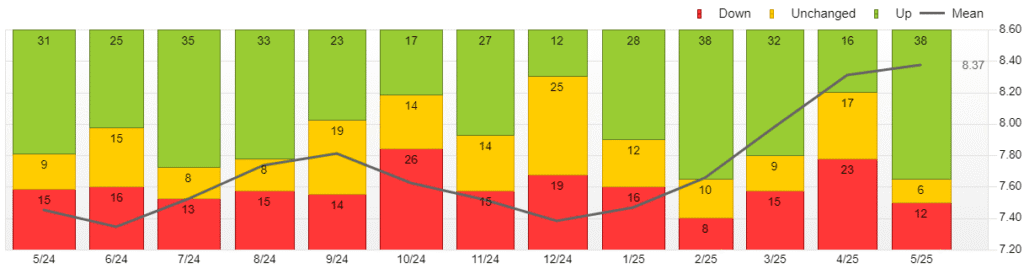

Earnings Revisions for Major European Banks

SocGen stays conservative but doesn’t miss the beat

Even Société Générale—long a poster child for the sector’s underperformance—showed signs of life. Q1 results were stable, and the bank guided to a cost/income ratio below 66% and ROTE above 8% for 2025. While cost reductions remain modest at 1% YoY, the bank’s focus on Boursorama’s growth, infrastructure financing, and equity client expansion is beginning to bear fruit. Crucially, the French retail unit is seeing improvement in RONE and capital distribution remains on track, targeting a 13% CET1 ratio with excess distributions possible once regulatory clarity around FRTB is achieved.

Valuation gap too wide to ignore

The bullishness is not just driven by earnings. It’s also a matter of valuation. Morgan Stanley now expects 10% EPS growth for the sector in 2026–27—yet the group trades at just 9x forward earnings. That’s not just a discount to the S&P 500; it’s a rebuke of years of investor neglect.

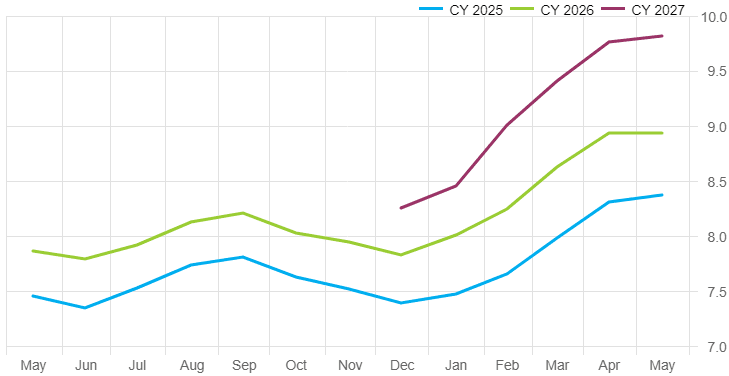

Recent consensus upgrades reflect this shift. EPS forecasts for 2025 and 2026 have been revised up by 11.9% and 14.1% over the past 18 months. The analyst revision trend is also increasingly skewed to the upside: 55% of revisions for 2025 were upgrades, compared to just 23% downgrades.

And the market is catching on. Across the last three months, the average EPS estimate has climbed from €7.60 to €8.37—a clean break from the stagnation of 2022–24.

European Banks EPS Consensus Trend

Far from a contrarian trade

This is not about hoping for a turnaround—it’s about recognising one already in motion. European banks aren’t just catching up; they’re finally writing their own narrative. With cleaner balance sheets, clear capital return frameworks and credible earnings power, the case is no longer underdogs hoping for a break. It’s strong, well-run institutions being priced like they aren’t.