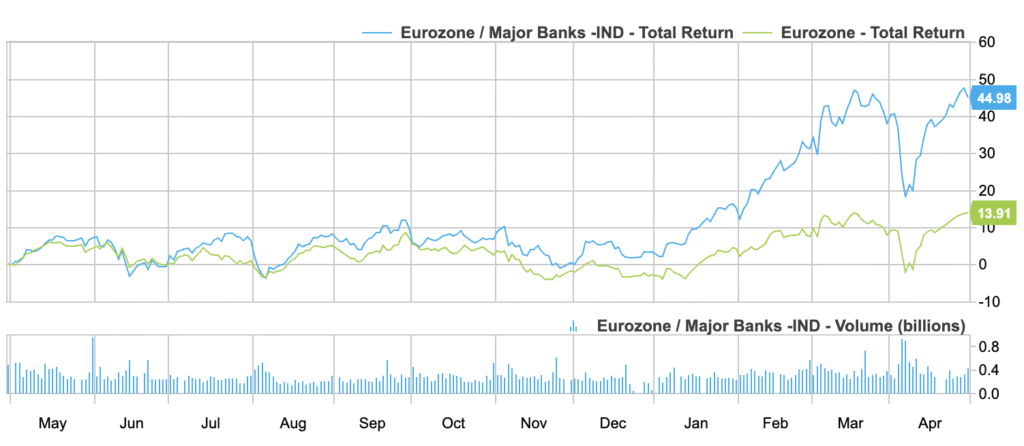

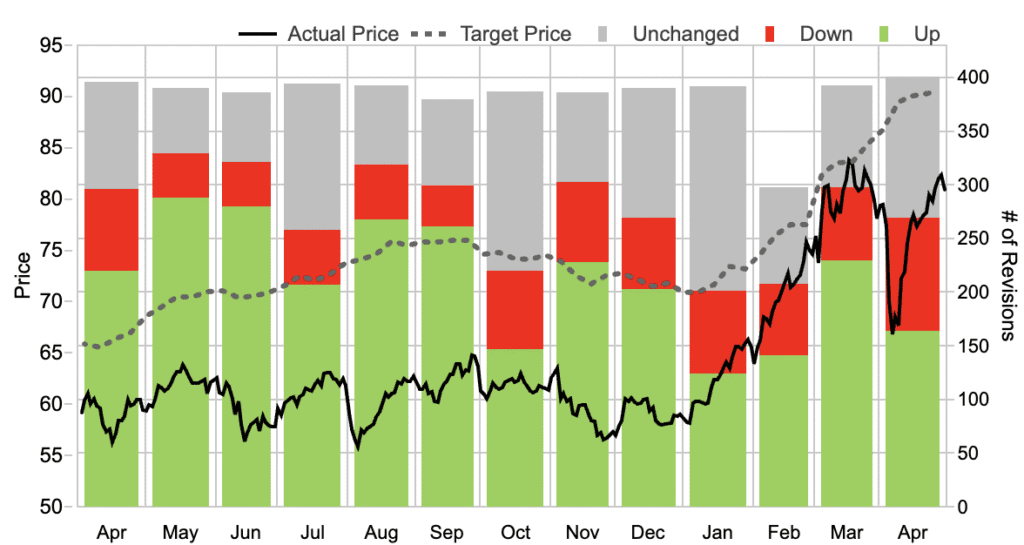

After a 40% share price performance year to date, earnings revision momentum for Eurozone banks has softened slightly. In April, 41% of analyst earnings revisions were upgrades (26% were downgrades and 33% unchanged), down from March’s 59% upgrade rate.

The slowdown doesn’t change the underlying story. From Société Générale and BNP Paribas to Santander, a clear pattern has emerged: disciplined cost control, solid credit quality, and a top-line boost from normalising interest margins are driving returns to levels last seen before the financial crisis.

41% positive earnings estimate revisions for Eurozone banks in April

Valuations catching up

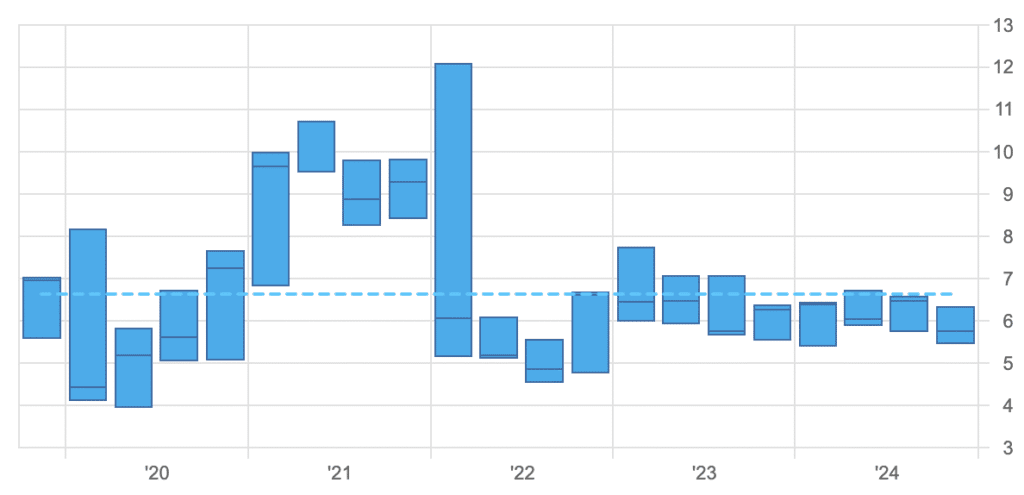

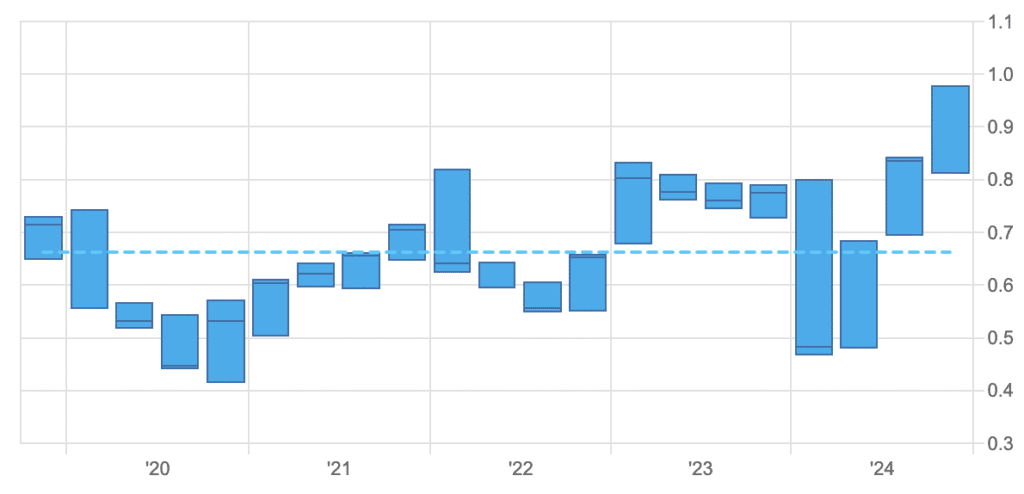

For more than a decade, Eurozone banks traded at a discount to book value, let alone to global peers. That’s starting to shift. The sector’s price/earnings ratio over the last twelve months (LTM) now stands at 8.2x, a decisive breakout from the 5.5–7.0x range of the past two years. Price-to-tangible-book has also climbed to 1.1x, the highest in recent memory, supported by earnings growth and improving returns on equity.

It’s a rerating that’s been a long time coming. Analysts across the board maintain Buy recommendations on major names such as BNP Paribas, Santander, ING, SocGen and Nordea. Only ABN AMRO remains closer to Hold.

Price/Earnings ratio LTM for the Eurozone banks,

Price/Tangible Book Eurozone Banks

Operating leverage is back—and so are the returns

BNP Paribas reported 6.1% revenue growth in its operating divisions for Q1, with CIB revenues up 12.5%, fuelled by a 42% jump in equities and prime services. Operating income rose 6.7%, supported by €190 million in cost savings already realised this quarter—part of a €600 million full-year target.

SocGen outpaced its own targets, slashing costs by over 4% and improving its cost-to-income ratio by 10 percentage points to 65%. ROTE came in at 11%, well above its 8% guidance.

Santander posted another record quarter: €3.4 billion in profit, up 19% year-on-year, with a 15.8% RoTE post-AT1. Efficiency ratios improved across the group, particularly in wealth and payments. With a CET1 ratio of 12.9% and rising returns on risk-weighted assets, Santander is targeting €10 billion in shareholder returns through buybacks in 2025–2026.

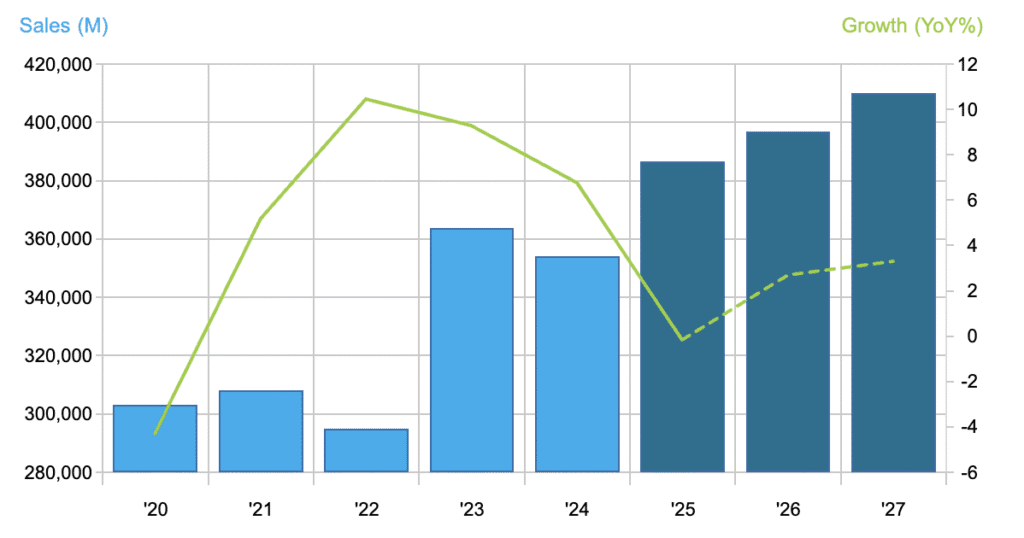

Revenue Eurozone Banks

Normalisation, not exuberance

This isn’t an industry riding a wave of euphoria. On the earnings calls, most CEOs struck a cautious tone on macro headwinds, geopolitical uncertainty, and the long tail of rate normalisation. BNP’s management highlighted the distortive effect of gold imports on GDP forecasts, with the Atlanta Fed’s GDPNow model flashing a -1.5% contraction for the US in Q1. SocGen acknowledged persistent market volatility and modest lending trends in France. Santander, meanwhile, reiterated that its strategy is built to withstand divergent interest rate paths across its global footprint.

But none of this overshadows the sector’s structural improvements. Return on tangible equity in the 11–16% range is no longer aspirational—it’s being delivered. And with credit quality still intact (BNP’s cost of risk held at 33 bps; SocGen’s at 23 bps), the floor under earnings appears higher than many investors expected.

After the 40% share price performance for Eurozone Banks year to date, analyst earnings revisions momentum have fallen somewhat. In April, 41% of analyst earnings revisions were upwards (26% down and 33& unchanged), which is a slight pullback from the very strong positive earnings revision momentum i March at 59% positive earnings revisions.