Resilient earnings and compressed valuations amid trade rerouting

The container shipping sector is navigating a paradox. Freight rates are sinking, yet charter rates remain stubbornly high. Spot rates, as measured by the Shanghai Containerized Freight Index, have plunged 61% from their July 2024 peak. But average charter rates have risen 11% year-on-year, a disconnect powered by a scarcity of mid-size vessels and strong demand for multi-year capacity. Contracts of two to three years are replacing pre-pandemic norms of just six months. In a market defined by geopolitical detours and structural bottlenecks, operators are paying up for flexibility.

This dynamic is sustaining cash flows even as freight demand softens. In Q1, Hapag-Lloyd reported preliminary EBITDA of €1.10 billion versus consensus estimates of €965.5 million, with EBIT at €500 million. Both volumes and average freight rates rose 9% year-on-year. Mitsui O.S.K. Lines surprised to the upside with Q4 net income of ¥57.4 billion, beating forecasts by more than 60%. Operating income reached ¥285.4 billion, and the company raised its year-end dividend.

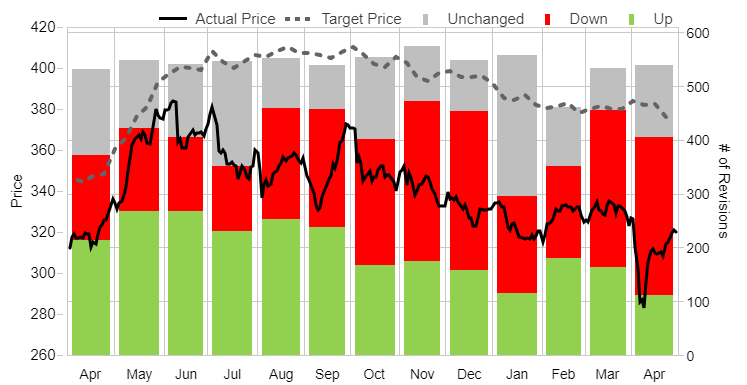

Earnings estimate revisions for global shipping

Earnings resilience meets valuation dislocation

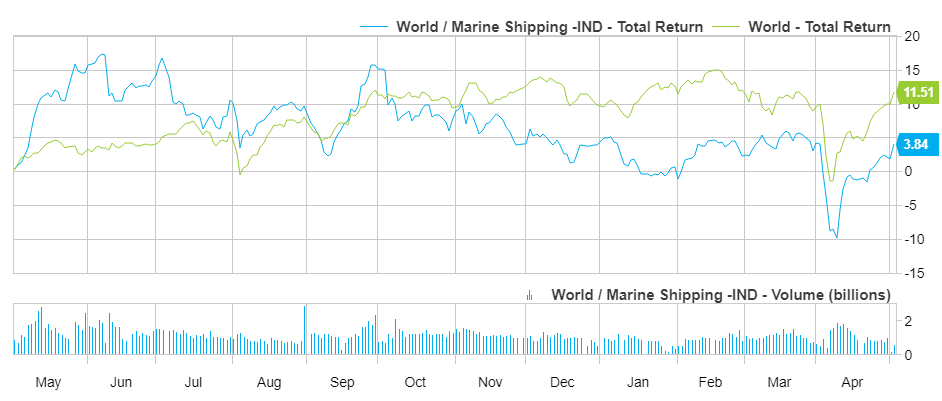

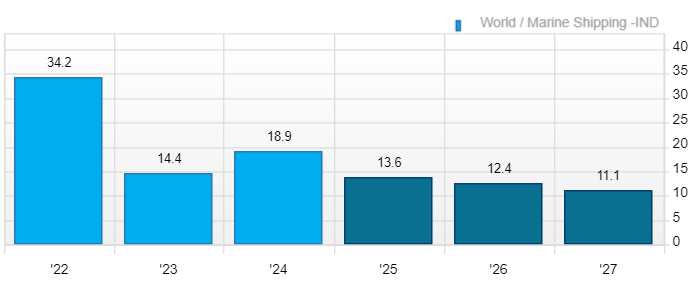

Despite these earnings beats, container shipping equities remain cheap. Maersk trades at just 6x trailing earnings; Hapag-Lloyd at 13.3x. Even Kuehne & Nagel, with a higher growth profile, has compressed to under 20x. The Marine Shipping -IND index is up only 3.8% year-to-date, lagging global equities. Meanwhile, EBIT margins have normalised from the 34% peak in 2022 to a projected 13.6% in 2025, yet many operators still enjoy healthy free cash flow yields.

Target price dispersion is narrowing as analysts reassess risk/reward. Capacity discipline, ageing fleets (median age 17–18 years), and a limited order book in sub-10,000 TEU vessels suggest sustained charter tightness. Fleet growth in this segment may even turn negative by 2028, once scrapping is factored in. For investors, this sets up a potential rerating story anchored in scarcity, not volume.

EBIT-margin for global shipping

Geopolitics redraw the map

This resilience isn’t occurring in a vacuum. U.S. proposals to impose port fees of up to $8.5 million per voyage on Chinese-built vessels are redrawing trade lanes. Shorter routes and sub-4,000 TEU ships may be exempt, supporting transshipment activity in the Caribbean and smaller tonnage demand. U.S.–China container volumes have already dropped 33% since the April tariff announcement, with traffic shifting toward Southeast Asia. Yet this is not a collapse, merely a redirection. Global trade fundamentals remain intact, just more circuitous.

Red Sea disruptions have further tightened the market, extending voyage times between Asia and Europe by 10 to 14 days and effectively inflating demand by 11–12%. Operators don’t expect a full routing normalisation before 2026. Meanwhile, the reefer segment is outperforming, as refrigerated cargo demand continues to grow faster than dry goods.

Valuation: P/E NTM for global shipping

Conclusion: new equilibrium, not temporary anomaly

Shipping is no longer a monolithic bet on global trade. In containers, price and capacity are decoupling. Earnings strength is not a function of booming freight demand but of strategic positioning, long-term charters, and trade realignment. As uncertainty persists, this bifurcation may endure. The divergence between spot and charter rates isn’t a fluke. It’s the new normal—and investors are only beginning to price it in.