Fresh inflation data from the US offered a brief reprieve, but investors aren’t exhaling just yet. From simmering US-China trade tensions to oil’s geopolitical bid and Europe’s equity revival, the global picture is anything but settled. Underneath the headlines, real risks linger, and the capital is already shifting.

Uneasy calm in trade as China and US inch forward

The apparent breakthrough between China and the US in London did little to steady markets. Yes, there’s a framework. No, there’s no peace. The so-called Geneva truce remains fragile, and the absence of detail only reinforces that uncertainty. Scott Bessent, Treasury’s voice of caution, was blunt: this will drag on. Export controls remain the key sticking point, with China imposing a six-month cap on rare-earth export licenses and the US threatening to reinstate restrictions if promises are broken. The market, rightly, is still pricing in risk.

Compounding the tension, Trump once again rattled the sabre, promising to unilaterally enforce US trade terms if deals aren’t struck within the next two weeks. The EU doesn’t share that urgency. Officials in Brussels expect talks to stretch beyond July, with only a vague deal-in-principle possible by then.

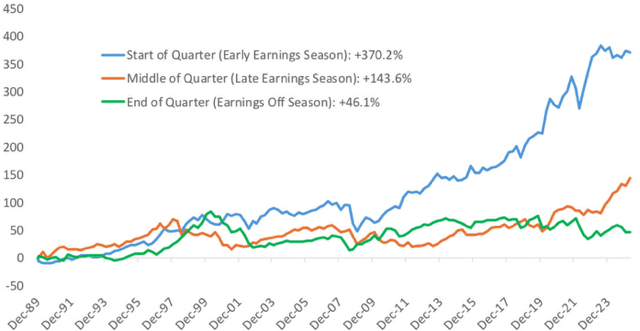

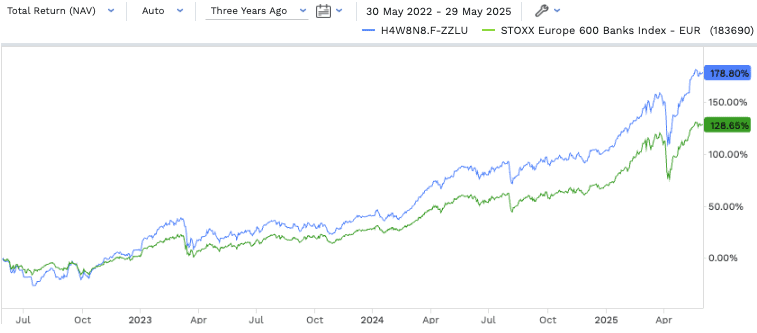

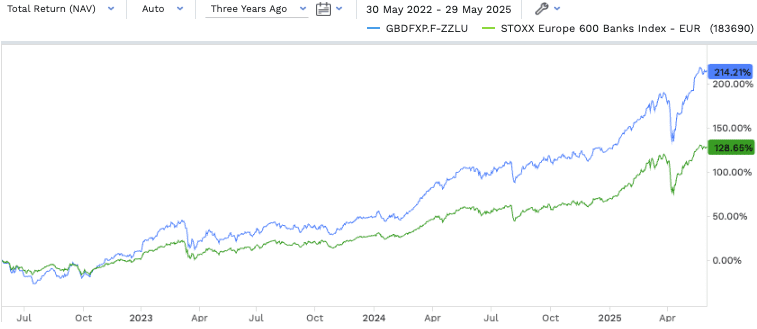

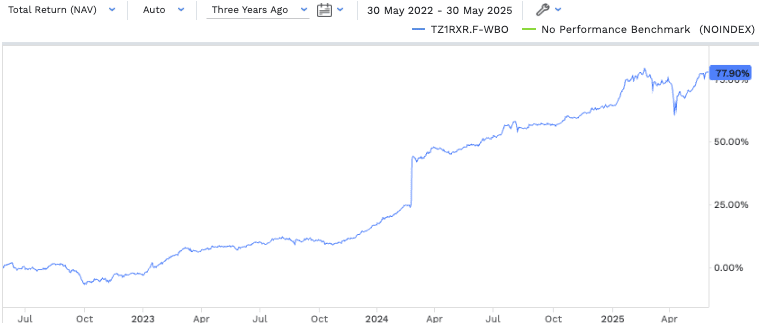

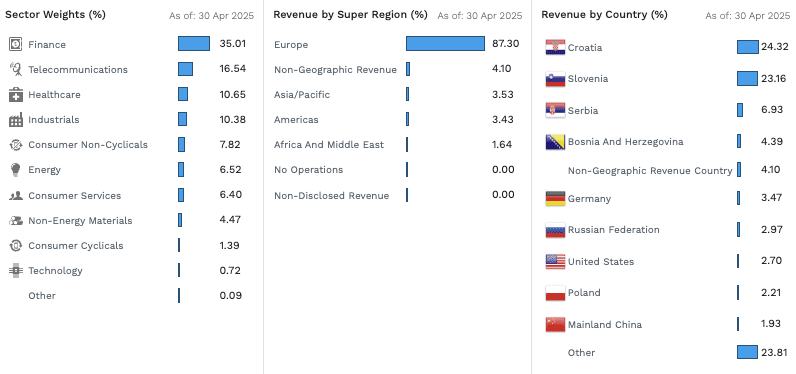

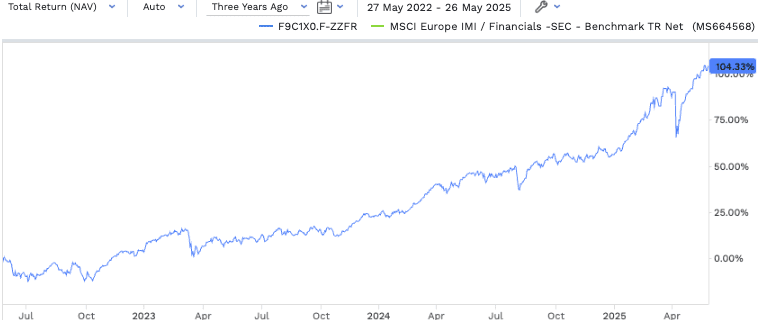

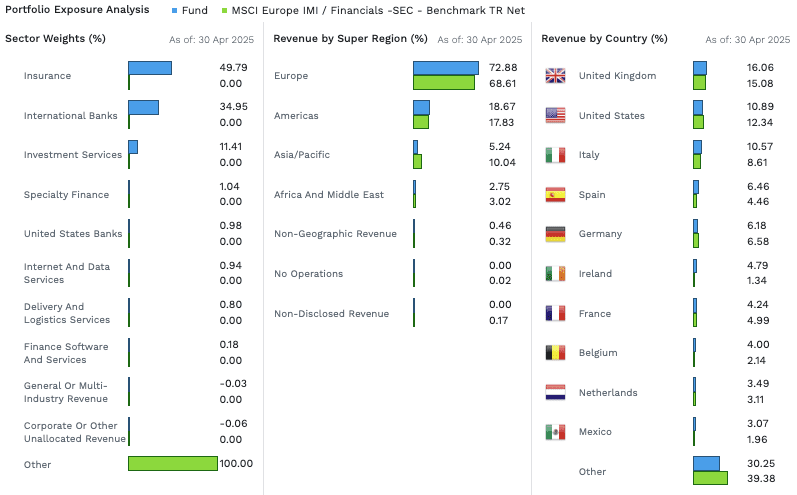

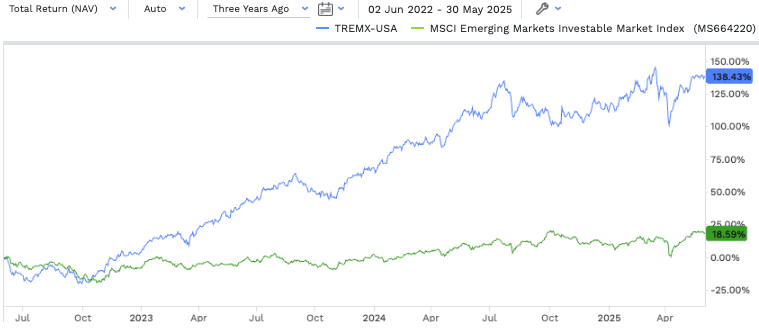

Meanwhile, capital flows tell their own story. In May alone, European equity funds pulled in $21 billion, bringing year-to-date inflows to $82.5 billion—the strongest showing in four years. US equity funds, by contrast, bled $24.7 billion, the worst month in a year. The rotation is not just about relative valuations—though Europe’s P/E at 13.5 looks modest beside the US’s 20.4—but about a broader reallocation of risk, driven by weakening dollar, unstable trade policy, and surging US deficits.

Inflation relief, bond bid, and gold’s stubborn rise

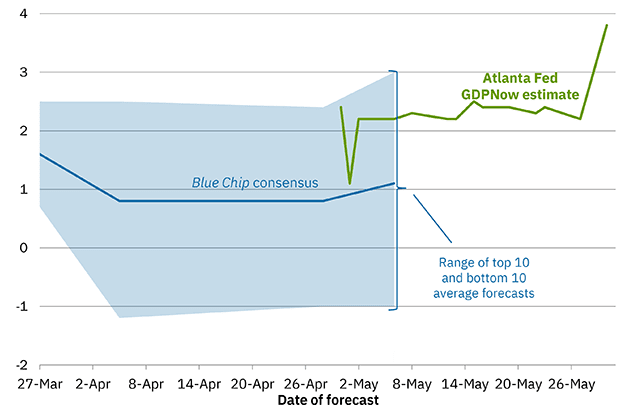

The May US CPI print surprised slightly to the downside at 0.1% month-on-month, against expectations of 0.2%. Year-on-year inflation stands at 2.4%. That marginal softness was enough to send yields and the dollar lower. The US 10-year slipped a basis point to 4.40%, and the CME FedWatch now prices in one to two rate cuts before year-end.

Yet despite this, gold moved higher. Not dramatically, but enough to confuse. The metal, often a hedge against inflation or geopolitical chaos, is climbing even as inflation softens. One reason: escalating supply risks. Barrick Mining has removed its Malian production from its 2025 guidance following a long-running dispute with the country’s government. Loulo-Gounkoto, one of its largest African gold assets, has been frozen since January due to an export ban. A court ruling is expected Thursday. Uncertainty in physical supply adds to the tension in financial markets.

Meanwhile, oil rose sharply again, bouncing nearly 5% in the previous session. This time it’s geopolitics. Talks between the US and Iran remain unresolved, with military threats on both sides. Washington has ordered partial embassy evacuations in the region, and Israeli airstrikes are reportedly on the table. Add to that a draw in US crude inventories and rising refinery runs—up 228,000 barrels per day week-on-week—and you get a textbook setup for higher crude prices. But this rally is skating on thin ice. New production capacity is due to come online in the autumn, threatening to tip the market back into oversupply.

Equity markets follow oil, sentiment follows Tesla

Energy stocks led Wall Street on Wednesday. ExxonMobil, ConocoPhillips, EOG Resources and Diamondback all posted solid gains. Palantir rose 2.7%, Broadcom added 3.38%, Starbucks jumped 4.33%, GE Vernova climbed 3.9% and Philip Morris moved up 2.42%.

Tesla rose again, fuelled by a video of its autonomous vehicles cruising through Austin and reports that Musk’s spat with Trump had quieted. A fragile peace of sorts.

In Europe, the picture was darker. The STOXX 600 slipped 0.8%, the DAX dropped 1.3%, and the CAC 40 fell 0.8%. Even the FTSE 100 was marginally lower. UK GDP data disappointed, and RICS housing data showed prices at a ten-month low. France revised down both growth and inflation. In Asia, Taiwan tech names dragged markets down, while Japan’s Ministry of Finance survey showed deteriorating business sentiment. Industrial metals bucked the trend, rising across the board.

Even fashion was hit. Inditex, owner of Zara, missed Q1 sales forecasts, sending H&M down 2.5% in sympathy. The consumer remains fickle, especially in discretionary spending.

A market moving sideways, eyes on everything

The backdrop is clear: no single narrative dominates. Geopolitics are back. Inflation is easing, but the Fed isn’t moving yet. Trade remains a wild card. Supply constraints push commodities up, while equity rotations and sentiment shifts scramble the usual signals.

It’s a market gripped by divergence. And divergence, as ever, demands attention.