Earnings defy gravity, but cracks widen below

It’s the most lacklustre earnings season since late 2023, and it shows. As of early May, STOXX 600 earnings per share are down 4% year-on-year according to Bank of America, dragged under by a 7.5% hit from the energy sector alone. Yet paradoxically, the actual earnings print is 6% above consensus. That curious strength is almost entirely the doing of banks and insurers. The financial sector posted a staggering 79% EPS beat ratio, dwarfing the broader market’s 52%. If Q1 hasn’t turned into a rout, it’s because financials dragged the rest uphill by their lapels.

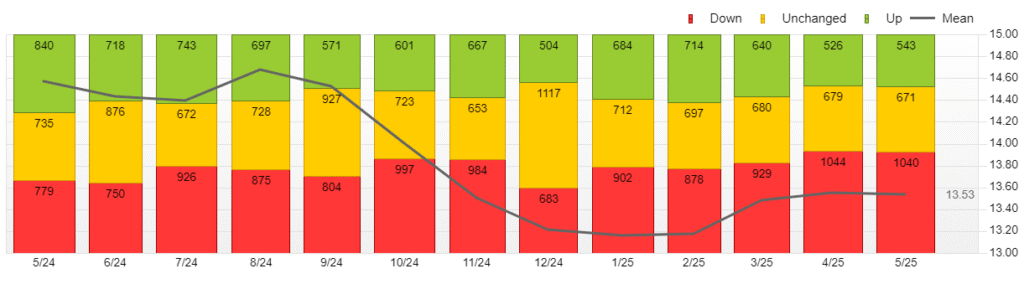

Europe STOXX 600 Performance

But this strength is narrowly distributed. Small-cap stocks—largely left behind by this cycle’s mega-cap obsession—showed a 9% EPS growth, providing a rare bright spot. And despite disappointing headline growth, analyst upgrades nudged Q1 EPS estimates up 4% since mid-April. Still, Q2 forecasts are rolling downhill. What was once a modest 4% expected growth has now flatlined to 0%. That reflects one clear message from corporates: demand is weak. Sales growth was flat in Q1 and is projected to contract by 3% in Q2.

Market reaction has been swift and merciless. Firms missing estimates are punished with a median one-day underperformance of 1.9%—one of the most brutal earnings reactions in over a decade.

Accelerating downwards revisions of analyst estimate for Euopean equities

Sectors split as sentiment thins

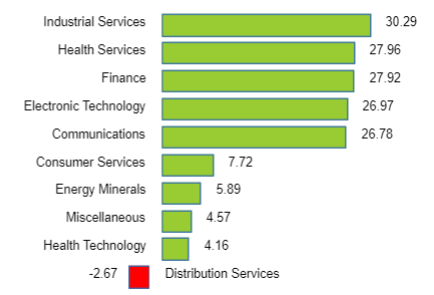

Despite Europe’s total return index posting a YTD gain of 16.48%, the rally has narrowed. Industrial services lead the charge with a 30.3% YTD return, trailed by health services and finance, each just shy of 28%. At the bottom, distribution services are the lone red mark, down 2.7% on the year.

Yet if you peel back valuations, it’s clear where expectations are being reset. Financials trade at just 10.7x forward earnings, with price-to-book at a spartan 1.33x—levels still attractive despite the recent rally. In contrast, sectors like electronic technology remain expensive, trading at 25.3x P/E CY1 with a bloated 5.3x price-to-book. Investors chasing performance here are paying dearly for growth that’s no longer guaranteed.

YTD Total return: Top/Bottom 5

Meanwhile, the performance dispersion across industries hints at deepening divergence. Recent winners include sin stocks (Tobacco +14.6% YTD), old-school manufacturing (Machinery +12.4%), and energy (Oil & Gas up over 6%). At the other end, tech peripherals (-18%), logistics (-16.9%), and online retail (-16%) are seeing valuations slashed, earnings missed, and guidance withdrawn. The scoreboard is brutal, and sentiment is increasingly binary.

Macro shadows lengthen, even as markets climb

Index levels may suggest calm. The STOXX 600 is up 5.5% YTD, the DAX has surged 17.3%, and Italy’s MIB gained nearly 14%. But beneath those numbers lies an uncomfortable truth: breadth is collapsing. As shown in the latest advance-decline data, more stocks are falling than rising. The proportion of “Up” stocks has shrunk from 840 in May last year to just 543 today, while losers now dominate the board.

Markets are being driven by selective outperformance and pockets of optimism. Energy minerals and industrials are firm, but consumer services, health tech, and distribution are stagnating or slipping. Investors are becoming surgical—rotating, not rushing.

The macro backdrop isn’t helping. Germany is bouncing with upside surprises in factory orders and trade, but in the UK, house prices are slowing and the Bank of England’s divided vote on a rate cut underscores growing uncertainty. Meanwhile, the Fed’s recent pause came with warnings: higher unemployment risk and persistent inflation. The market is now pricing in a 57% chance of a July rate cut—but that’s hardly reassuring when paired with evaporating Q2 earnings growth.

Hope hangs on the few

Europe’s equity rally is intact—just barely. Q1 results delivered more surprises than disasters, but only because financials overachieved and small caps punched above their weight. Under the surface, earnings are fragile, margins are shrinking, and market reactions are turning vicious. Valuations remain bifurcated, and breadth is thinning to its weakest in years. Unless demand returns or guidance firms up, the risk is not rotation—it’s retreat.

For now, fund managers should thank the banks. Without them, Q1 might have turned into something worse than forgettable.