US-UK tensions reignite over trade deals

London is once again caught between Brussels and Washington. As the UK edges closer to a new pact with the EU—one that would align food and veterinary standards—Washington is crying foul. The US Department of Agriculture has warned that such alignment would limit Britain’s ability to strike a bilateral trade deal with the US.

Timing is tight. A joint UK-EU summit looms on 19 May, with declarations expected on Ukraine, trade, and climate. Britain had hoped to wrap up a US trade deal before then to avoid being boxed in. But in classic American style, the UK isn’t even at the front of the queue. Sources suggest a Trump-led administration sees a UK deal as a “second-order” priority. The US has carved its trade talks into three phases, and Britain sits squarely in phase two or three. Negotiators now face a US-imposed 8 July deadline, slipping well past the UK’s own target. American focus, at least for now, is in Asia.

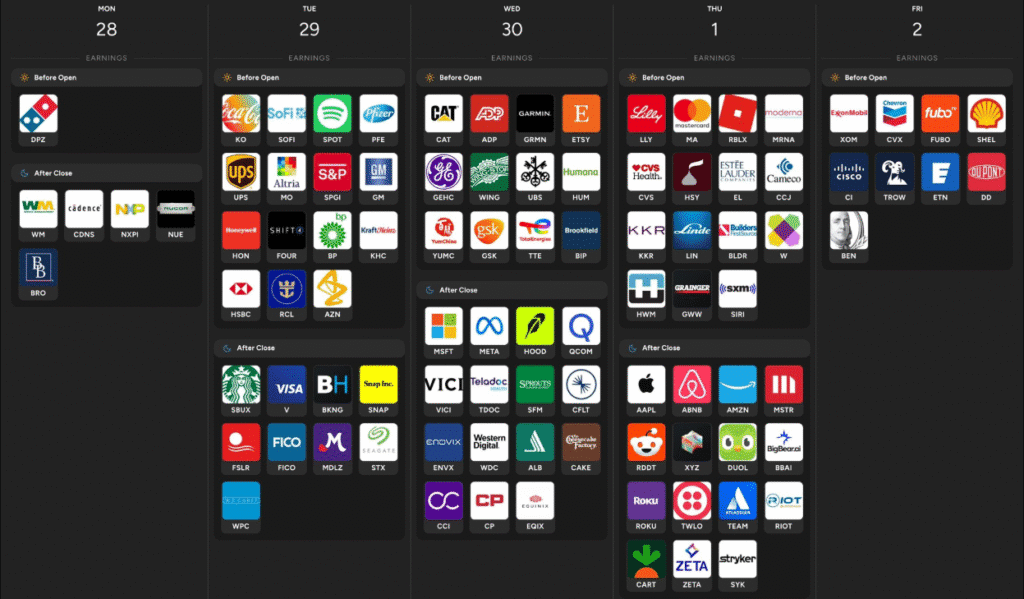

Electrolux craters while Booking disappoints after hours

Swedish investors saw a bloodbath in Electrolux, which fell 17.5% on earnings—easily the day’s standout collapse. While a small bounce followed, history says such drops tend to attract more selling, not bargain hunting.

Across the Atlantic, Booking.com turned in a strong earnings beat, with profits up 22% year-on-year. But shares still sank 3.5% in after-hours trading, a classic case of high expectations meeting reality. Room bookings slightly missed estimates, and when a stock has already performed well—like Booking has this year—any hint of weakness sparks selling. Its rival Expedia, more exposed to the US consumer, is down 14% year to date.

GDP models miss the mark as gold distorts the picture

On the macro front in the US, the Atlanta Fed’s GDPNow model is flashing warning signs—predicting a 1.5% annualised contraction. The culprit? Gold imports. The model, still using a pre-May methodology, penalises GDP for rising imports of the yellow metal, leading to outsized downgrades.

The broader expectation is still for a slowdown rather than outright contraction. The import surge, linked to pre-tariff stockpiling, may prove transitory. Still, the narrative of a cooling US economy is gaining traction.

Meanwhile, JOLTS data showed fewer job openings, but more people quitting voluntarily—suggesting confidence in the labour market. That’s a glass-half-full reading. In times of fear, workers cling to jobs. When they quit, it often means they see better prospects elsewhere.

The ghosts of April returns

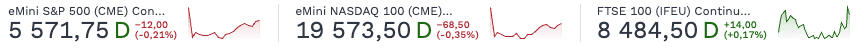

Today marks the final trading day of April. If history is any guide, it won’t be pretty. Since 2004, 30 April has delivered a median return of -0.22% for the Dow, -0.39% for the S&P 500, -0.74% for the Nasdaq, and a bruising -0.92% for the Russell 2000. Just 7 of the past 21 years have produced green closes for the Nasdaq and S&P.

And yet, optimism lingers. Trump’s 100-day speech may have been a campaign rehash, but markets still gained. DJIA climbed 0.75%, and both the S&P and Nasdaq added 0.6%—marking six straight days of gains, buoyed by easing auto tariffs and talk of trade deals with India, Japan, and South Korea.

Europe, too, saw modest gains (Stoxx 600 +0.4%), but sentiment soured as weak results from Super Micro Computer dragged tech down. MAG7 giants—Meta, Microsoft, Apple, Amazon—report this week, setting the tone for May.

In China, the effects of the trade war are showing. April’s official manufacturing PMI dipped to 49.0, the lowest since December. Still, private surveys like Caixin and service sector numbers offer a flicker of resilience.

As earnings season collides with geopolitical brinkmanship and muddied macro signals, one thing is clear: clarity is not on the menu. Markets are squinting into May with one hand on the sell button and the other checking Powell’s next move.