Här är brödtexten på mitt första inlägg

Här är brödtexten på mitt första inlägg

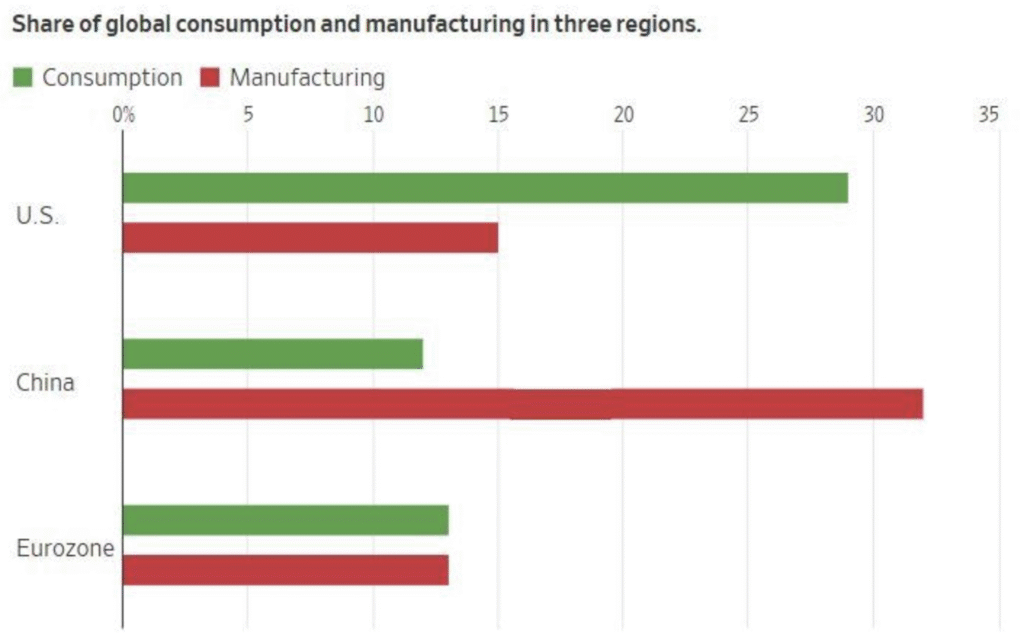

Source: Deutsche Bank

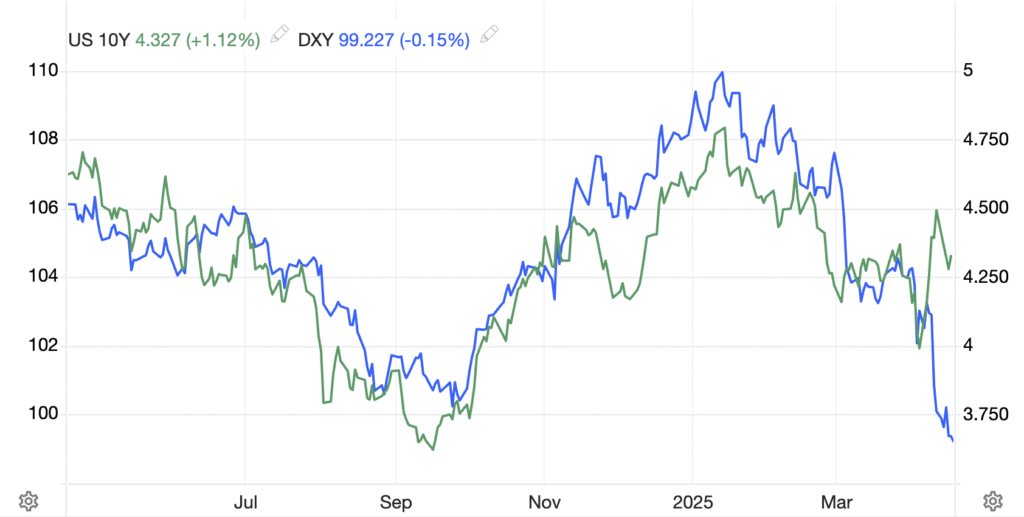

Image: Trading Economics

As the Q2 earnings season kicks off across Europe and beyond, investors face a market narrative riddled with contradictions — soft landings and hard signals, recovering consumers and contracting PMIs. Add geopolitical overhangs and volatile currencies, and the result is a reporting season where clarity will be at a premium.

Here we highlight five themes that could shape both sentiment and stock prices in the coming weeks.

From trade tensions and tariff talk to regional elections and escalations, macro uncertainty continues to shape the operating environment for European corporates. While many industrial names have rallied since the beginning of the year, earnings releases will now reveal how much of that optimism is grounded in fundamentals — and how exposed global supply chains really are.

Key metrics to watch: order intake, commentary on North American demand, and FX-adjusted margin resilience among industrial leaders such as Schneider Electric, ABB, Volkswagen, and Siemens.

Hopes were high for a consumption rebound in 2025, driven by cooling inflation and real wage gains. But recent confidence indicators in Germany, France and the Nordics suggest a hesitant consumer — and mixed signals from US retail earnings are reinforcing the caution.

Retailers, discretionary brands, and housing-related names such as H&M, Zalando, Kingfisher, and Electrolux will offer early clues. Any guidance on Q3 trends will be key for judging whether we’re seeing a pause — or the start of a new downcycle.

The euro has strengthened markedly against the US dollar since January — helping import-heavy businesses, but posing challenges for exporters with significant dollar-revenue exposure.

Many firms report in euros but earn in dollars — meaning sectors like paper and pulp, engineering, and semiconductors could see compression in Q2 margins. On the flip side, apparel retailers and electronics importers may benefit from improved purchasing power. Watch earnings commentary from firms like Stora Enso, ASML, and Inditex for early signals.

Rising rates in early 2024 boosted net interest income for banks across Europe — but with policy now in transition and bond yields swinging on macro headlines, the environment is less predictable.

Meanwhile, commercial property remains under stress. Many firms still face refinancing at higher costs, and valuation adjustments continue to weigh. Expect analysts to scrutinise funding structures, debt covenants and asset sales in real estate names — and capital efficiency in banks. Surprises could emerge on both sides.

Earnings season is as much about tone and interpretation as it is about numbers. Companies beating on revenue and profit may still be punished if cash flow weakens or forward guidance turns cautious. At the same time, modest results from a previously discounted company can spark powerful rallies.

This quarter, investors are on edge — alert for any sign of resilience against geopolitical noise, softening demand or FX pressures. The early part of the season will reveal whether the market rewards signs of stability or punishes any hint of fragility.

Watch the early reactions closely — they may set the tone for the entire reporting cycle.

Welcome to WordPress. This is your first post. Edit or delete it, then start writing!