EPS estimates under pressure across the board

In the first two months of Q2, analysts lowered earnings per share forecasts for S&P 500 companies by 4.0%, from $65.55 to $62.91. That’s not a routine adjustment. It exceeds the average cut seen over any comparable period in the past five, ten, fifteen or even twenty years. For reference, the 20-year average cut for this stage of the quarter stands at 3.1%.

Not a single sector escaped the knife. Energy bore the brunt, with analysts slashing Q2 EPS estimates by 18.9%. For the full year 2025, the picture doesn’t improve. EPS forecasts have dropped by 3.5% since December, again more than the typical five-month downdraft. Materials have been hit hard too, down 11.8%, while Energy again leads the decline at -17.6%. The only sector where optimism hasn’t eroded? Communication services, where EPS estimates actually rose 2.3%.

This isn’t just cautious housekeeping. It reflects real concern that pricing pressure, weakening demand, and higher input costs, some policy-induced, are colliding at precisely the wrong time. And the street is finally pricing that in.

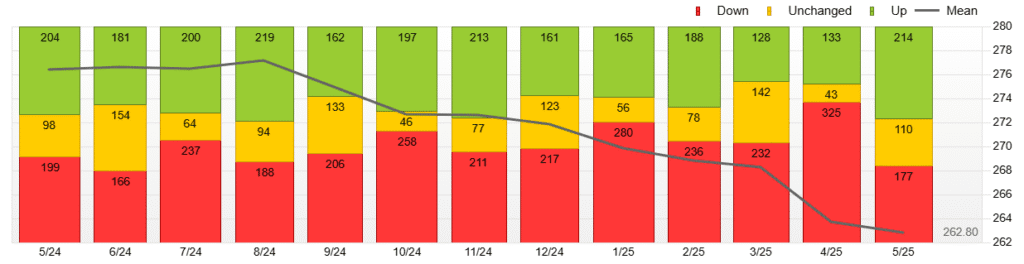

S&P500 Earnings revision trend

Markets digest tariff whiplash and mixed macro signals

US equity markets, while choppy, ended May on a broadly positive note. The S&P 500 and Nasdaq clocked their best monthly performance since November 2023. Yet the path there was uneven. Big tech couldn’t hold its footing late last week, Nvidia and Tesla both declined, and cyclicals like energy, semiconductors, and asset managers fell behind. Treasuries firmed, the yield curve steepened, and safe havens like gold lost ground.

Trade politics are dominating the risk conversation. A fresh volley from Donald Trump accused China of violating trade agreements and floated new tech sanctions. At the same time, whispers of a possible Trump-Xi phone call suggest the usual choreography of escalation and détente. But markets have seen this playbook before, and patience is wearing thin.

Meanwhile, macro data is sending mixed signals. April’s core PCE inflation landed at 2.5% year-on-year, a post-2021 low, but personal spending came in soft, up just 0.2% month-on-month. Consumer sentiment ticked up, aided by perceived trade optimism, but inflation expectations remain unstable. The May Chicago PMI slipped to its weakest since January, further complicating the picture.

Europe braces for tariffs and a final ‘easy’ cut from the ECB

European equity markets opened the week on a softer note. The DAX gave back 0.3% after hitting record highs last week. Broader indices, including the STOXX 600 and CAC 40, nudged lower. The European Commission made clear it is ready to retaliate against Trump’s plan to double tariffs on steel and aluminium, warning that the move threatens to unravel months of trade diplomacy. That threat, initially aimed at 1 June implementation, has been temporarily shelved, but not resolved.

This week’s European Central Bank meeting is shaping up as a pivotal one. The ECB is expected to deliver a 25 bp rate cut, bringing the deposit rate to 2%. But it’s likely to be the last straightforward move for a while. Inflation data supports easing, but rising consumer inflation expectations and ongoing supply chain frictions muddy the outlook. The market expects the easing cycle to end by September, pricing a year-end deposit rate of 1.75%.

Structural factors—such as a tight labour market and ageing demographics—may continue to exert upward pressure on inflation, even as near-term growth slows. Some analysts warn that without a material growth undershoot, future cuts could become politically or economically costly.

A market groping through fog

The broader picture is one of dislocation. Earnings expectations are falling, not just adjusting. Trade threats are headline material again. Central banks are nearing the end of their room to manoeuvre. And yet, market sentiment hasn’t broken, just softened.

This is not a crisis moment. But it is a pivot. Investors, analysts and policymakers alike are facing a more complex backdrop than they were even six months ago. The soft landing narrative still exists, but it’s starting to feel like a theory waiting to be disproved.