A fragmented cycle with megatrends intact

In theory, the sector should be flying. Global investment in AI, grid modernisation, electrification, and energy efficiency is hitting all-time highs. In practice, only some parts of the industrial tech world are getting the lift. Data centres and utility infrastructure are surging; machine builders, automotive plants, and discrete automation are stalling. That divergence is holding back even the strongest names.

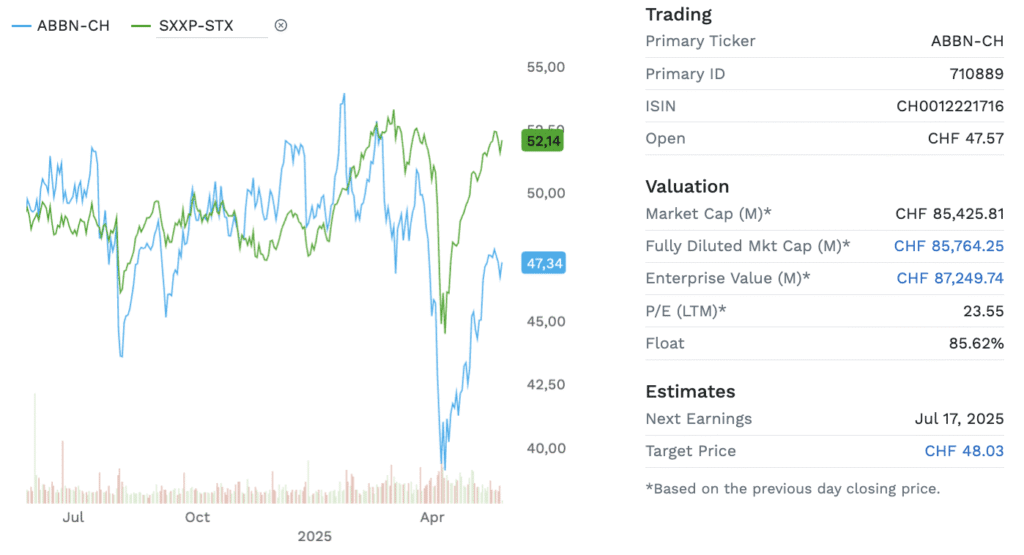

ABB, for example, is stuck in neutral. While Electrification is powering ahead—17% order growth in Q4—its Robotics and Discrete Automation division has been hammered, with margins in that unit falling below 8%. The company is coming off a long restructuring and has begun acquiring capabilities again (including Sensorfact and Gamesa Electric), but it’s still caught in a soft patch. Sub-1.0x book-to-bill in Q4 signals caution. CEO Morten Wierod is betting that 2025 will mark a turning point—but if it comes, it will be uneven.

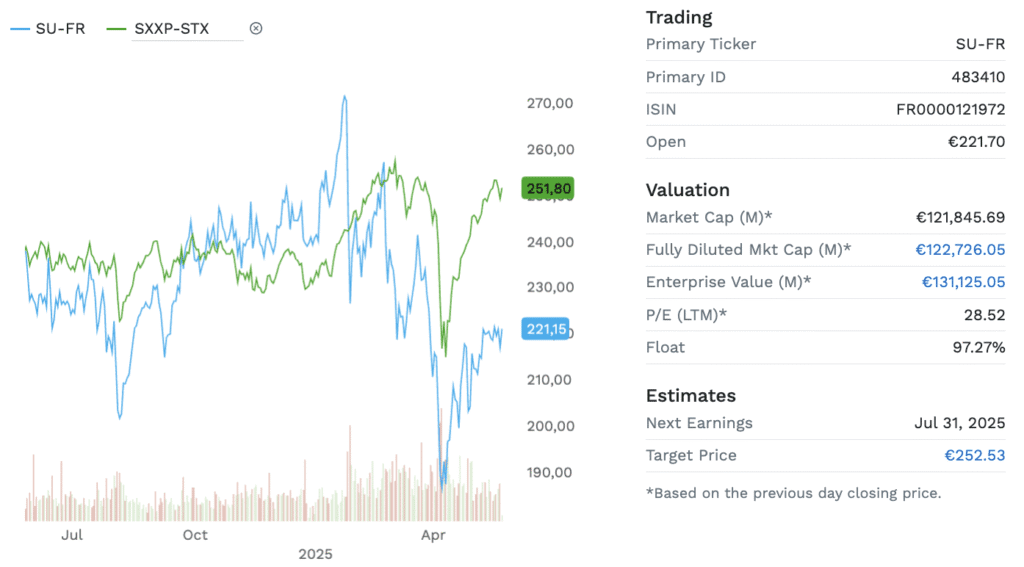

Schneider Electric Share price performance

Schneider Electric is in better shape. Revenue rose 8% in 2024, EBITA margins rose nearly 100 bps, and data centre exposure is proving a consistent tailwind. The acquisition of Motivair, a cooling technology provider for high-density servers, shows how tightly Schneider is hitching itself to the AI hardware boom. But even here, cracks are visible. Residential demand is soft. Industrial automation fell 4%. And with the stock trading around 30x forward earnings, expectations are already priced for perfection.

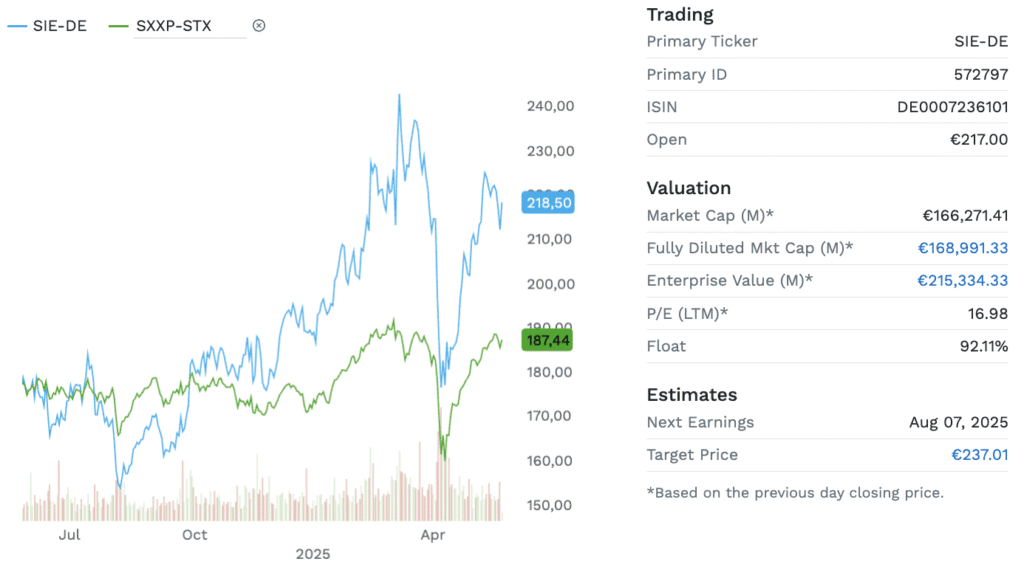

Siemens Share price performance

Siemens, the most diversified of the bunch, has its own balancing act. Digital Industries declined 11% in Q1 2025, yet Smart Infrastructure rose 8% and Mobility 10%, supported by a €118 billion backlog. The acquisition of Altair and Dotmatics marks a push into software and AI-powered life sciences, further tilting Siemens toward higher-margin tech. But the group remains exposed to cyclical pain, particularly in Europe. Meanwhile, inflation and tariffs are complicating the investment case.

Data centres and utilities are the growth engine now

If one theme connects all three companies, it’s this: data centres are the new factories. Schneider, with its deep strength in uninterruptible power supply (UPS) systems and rack-level energy management, is perhaps best placed. Eaton and Siemens are also seeing 10%+ growth in their data centre-related divisions. Power demand is shifting structurally upward, and with AI workloads pushing power densities to new extremes, medium- and high-voltage gear is back in vogue.

Utilities, too, are still investing. ABB’s medium-voltage equipment and Schneider’s smart grid platforms are benefiting from a wave of modernisation and hardening. The logic is simple: before more industries can electrify, the grid needs to be ready.

But beyond these two segments, the picture darkens. Machine-building is weak. Auto is soft. Electronics are volatile. Oil and gas, flat. This uneven demand is why no player is delivering on all fronts, and why even strong quarterly earnings are being met with investor hesitation.

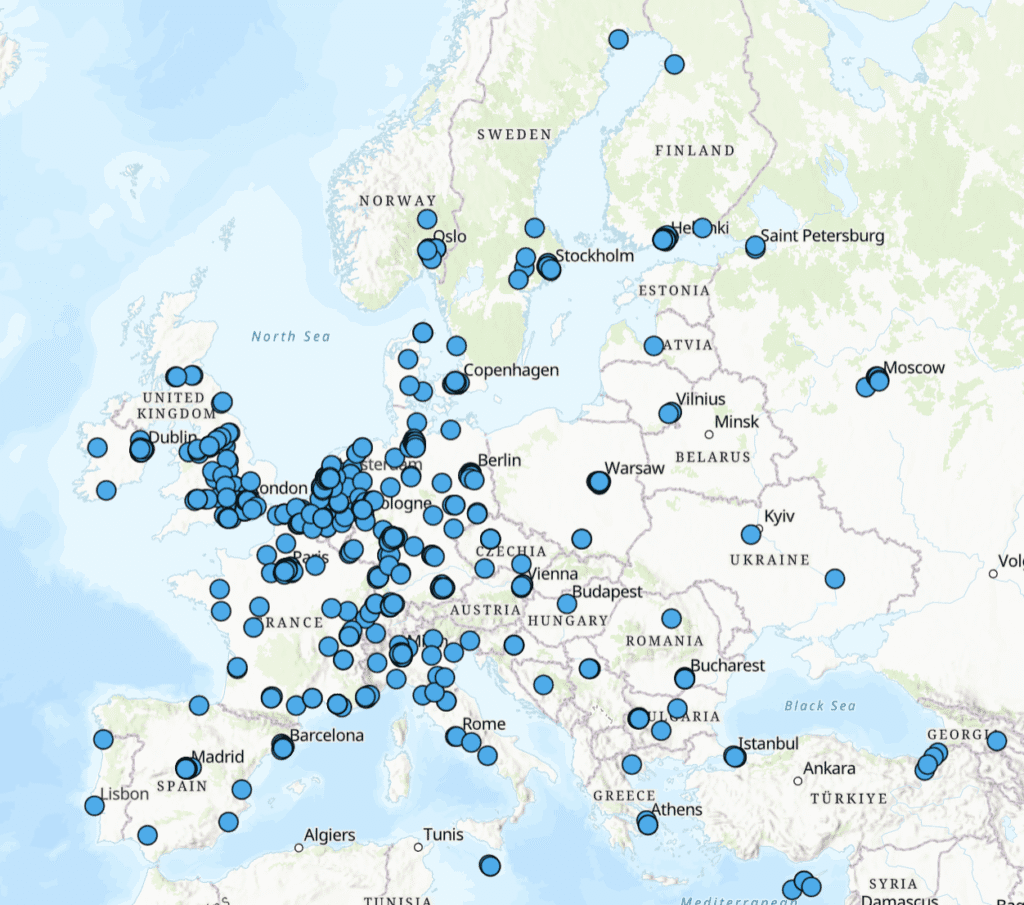

4244 Datacenters in Europe

The transition from hardware to systems and software

All three groups are trying to escape the volatility of product cycles by leaning harder into software and services. Siemens’ Xcelerator, Schneider’s AVEVA suite, and ABB’s growing industrial analytics capabilities are meant to generate recurring revenues and smooth the cycle. The shift is slow but real. Schneider still gets 50% of revenue from traditional products, and its software + systems only make up 19% of the top line—but that number is rising. SaaS transitions (especially in ETAP and RIB) are under way, if not yet fully reflected in margins.

ABB Share price performance

Strategically, all are pursuing bolt-on acquisitions. Schneider’s Motivair deal cost $850 million. Siemens bought Altair for €9.3 billion and Dotmatics for €4.5 billion. ABB is more surgical, targeting capabilities in power electronics, analytics, and digital twins. These aren’t trophy deals. They’re positioning moves, aimed at embedding each company deeper into infrastructure’s digital nervous system.

Outlook: muddling through before the next leg higher

The long-term story is intact. The next wave of industrial capex will be digital, electric, and AI-infused. But 2025 is shaping up to be a transition year. Book-to-bill ratios below 1.0, destocking, and cautious industrial clients mean the first half may disappoint. If geopolitical tensions and tariffs escalate, it could be worse.

Still, this is no cyclical bust. Order books remain fat. Balance sheets are clean. Margins are holding. The only thing missing, for now, is broad-based momentum. For industrial tech, the future remains electric—but the present demands patience.