Cyclical sectors roar as tariffs retreat

European markets jumped out of the gate, with the STOXX 600 gaining 1.1%, CAC 40 up 1.5%, and DAX adding 0.7% to notch yet another record high. The spark? A rare outbreak of diplomatic common sense: the US and China agreed to slash mutual tariffs for 90 days, cutting US levies from 145% to 30% and China’s from 125% to 10%.

That détente was enough to light a fire under every pro-growth sector in Europe. Basic Resources soared on expectations of higher Chinese metals demand, with miners like Glencore and Anglo American among top gainers. Auto stocks—previously paralysed by tariff uncertainty—finally caught a break. Stellantis and Mercedes-Benz, both of which recently scrapped guidance, rallied hard as analysts estimated 8% and 3% potential FY25 EBIT boosts, respectively, from resumed SUV exports to China.

Semis and consumer names weren’t far behind. European chipmakers popped 6–10%, while luxury stocks like LVMH and Kering surged alongside Adidas and Puma. Even the shipping sector joined the party, with Maersk and Hapag-Lloyd rallying on hopes of renewed freight flows. The energy complex followed suit—Shell and TotalEnergies moved sharply higher on stronger demand prospects.

But not everything rallied. Healthcare fell on reports that Trump plans an executive order slashing US drug prices by up to 80%. Novo Nordisk slumped further after Eli Lilly’s Zepbound showed superior results to Wegovy. Defensive sectors—Utilities, Real Estate, and Telecom—lagged across the board.

Rates, risk and the road ahead

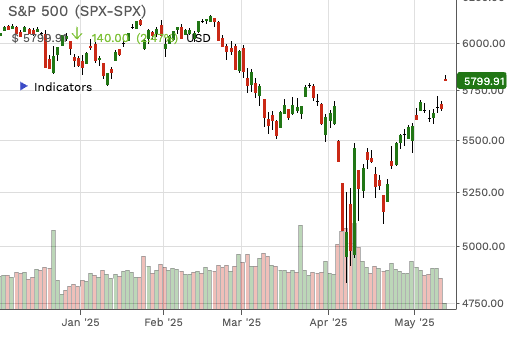

The market’s euphoric reaction masks a sobering reality: risk assets are now priced for near-perfection. The VIX has dipped back under 20—levels last seen in March, when the S&P 500 traded between 5,500 and 5,800. Back then, yields were closer to 3.9%. Today, they’re pushing 4.6%, with the US 10-year yield back at its April highs.

Unless yields fall back below 4% and the VIX slides toward 15, it’s hard to see how equities can push sustainably higher. As it stands, the S&P is fully valued relative to current rate and volatility conditions. The bond market’s message is no more reassuring: a bear flattening in Treasuries saw short-term yields rise 10–12 basis points, as traders scale back expectations for Fed cuts to just 50 bps this year.

And yet, markets are hoping for the best. Why? Because despite persistent deflation pressures in China, solid wage growth (3.6% y/y), and sticky core inflation (2.6% PCE), the Fed refuses to budge from its 4.25% policy rate. The strong US labour market keeps policymakers on edge. With firms still hiring and demand intact, Powell & Co. are understandably reluctant to trust that inflation will drift toward target.

S&P 500 gap up on Monday

The line in the sand is 5,300

Technically, equities aren’t behaving like they’re in a bear market. The structure more closely resembles a one-time shock—much like March 2020’s COVID panic—than a protracted decline. The key level to watch now is 5,300–5,500 on the S&P. That zone held firm through recent volatility, and as long as it does, the bull case remains intact.

But let’s be clear: this market is overbought. A reaction lower is overdue. If this tariff truce crumbles, or inflation surprises to the upside, there’s 10% downside risk in a heartbeat. This week’s US CPI will be crucial, along with Empire Fed, PPI, retail sales and housing data. Sweden’s inflation data will also be watched for signs of imported disinflation—or the lack thereof.

Until then, equity bulls are dancing on a narrow ridge, with loose footing on both sides.